Okay, yesterday, I dealt with the theoretical and philosphical in our discussion of moral hazard. Almost more of a topic for a college class than a blog about the mortgage world, don’t you think?

Well, today we’re going to get more into the every day nitty gritty with the Top 7 things (in random order) that I think everyone who is looking to buy or sell in today’s market needs to know:

1. 6 months ago is ancient history. What your neighbor sold his house for 6 months ago doesn’t matter. What the seller was asking for the house 6 months ago doesn’t matter. What matters is what the market will support today.

2. Don’t worry so much about what you paid for your house. Instead, look at the difference between what you can expect to sell your house for and what it’s going to cost you to buy the new one that you want. I expect you’ll find that those are much more important numbers (unless you end up without any equity in which case you don’t sell).

3. Now is not the time for do-it-yourselfers. When the inventory levels are, depending on property type and area, any where from twice as much as is healthy (single family homes near my hometown) to 750% as much inventory as there should be (condos in Florida from what I’ve heard), you need to find a professional to help you navigate the markets and get your house noticed. I’m not, frankly, just talking about calling the Realtor who sold the house up the street. I’m talking about calling a high caliber professional who knows what it takes and can really give your house the attention that it needs. People like Greg and Teri and Jeff are examples of the types of Realtors who have the knowledge and talent to help you navigate through this market and make wise decisions.

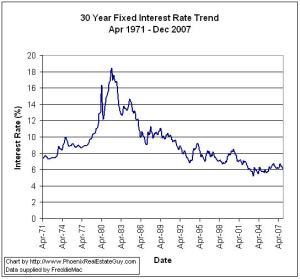

4. Any interest rate that starts with a 6 is a good number. Check out the attached chart. From 1971 to 1998, we did not see any mortgage rates that started with a 6. Frankly, we’ve gotten spoiled in an era of cheap credit and we need to keep things in perspective.

5. There is a Tangible Difference in working with a true mortgage professional. I’m not talking about the difference between a mortgage broker (like Brian Brady) or a mortgage lender at a bank (like yours truly). I’m talking about the difference between someone who can help you navigate the changing environment that we’re in. Read The Tangible Difference and you’ll see what I mean.

6. Don’t buy a house today if you aren’t going to stay there at least 7 years. That’s right, a mortgage lender is telling you that if you don’t have at least a 7 year time frame in mind, you shouldn’t buy a house right now. Why? It’s all about the math. If the market drops another 5% over the next year and then stays the same for two years, it’s going to take 7 years for you to recoup the 5% loss and then build up enough to pay the 6% Realtor’s fees when you sell and make a little profit too. Long term, the value of real estate investments is very solid, but this market has spread things out a bit longer.

7. It really is a good time to buy a house. No, I’m not turning into a National Association of Realtors choir boy. If you go into the transaction with the right mindset (long term investment), with a talented group of professionals (Realtor, lender, inspector and accountant) backing you up, and you remain analytical about the financials and keep the emotions from forcing decisions, I firmly believe that you’ll find yourself very glad that you made the move you made. Is it the right time for everyone to buy and sell? Nope, but I have the feeling that there are a lot of people sitting on the sidelines because they are scared of what the mainstream media has done to the portrayal of the markets and are missing out on some great opportunities to move forward and upward.

Yesterday was the theoretical, today is the practical. If you have questions about it or want to discuss it further, let me know.

Tom Vanderwell

Brian Brady says:

Good insights, Tom. I might argue against #4 and #6:

#4- If we took that chart back to the 1930s we’d see long-term mortgage rates fluctuate between 5.5-6.5%; The 1980-1990 period looks like a spike. While it’s easy to suggest that the conditions of 2008 look like 1978 (stagflation), our marginal income tax rates are substantially lower which should help to keep mortgage rates in that trading range. Will rates spike to 7% next year…maybe but I think we’ll see them within that 5.5-6.5 range after that.

#6- Good advice about the long-term. Certain markets might surprise you though. For example, I think Phoenix, Vegas and SoCal may recover in a V-shaped fashion. If we have another 5% down here, we could see a 25% spike once lenders recover.

I’m sure there will be some naysayers to tell you why I’m all wet so give them a chance before you reply.

PS: BONUS #7- You know when it’s a GREAT time to buy a home? When the cost of rent equals the after-tax cost of owning. That’s doable in some spots (already) and getting there in others.

July 23, 2008 — 6:47 pm

David Shafer says:

Brian, about #7, does that include opportunity costs?

July 24, 2008 — 5:16 am

Brian Brady says:

Good question, Dave. Market timing vs. getting a good return is like the difference between a 300 yard drive and bogey golf; both are desirable but hard to achieve.

The former is for show while the latter is for dough. I can’t consistently drive the ball so I focus on bogey golf.

Call my theory a layup before the water hazard. Its cautious but it helps me break 90.

July 24, 2008 — 8:18 am

Dylan Darling says:

#7, the question asked daily! I agree with your answer- it could be the right time.

@Brian- Good point on #6. Certain markets are still doing alright, and some will recover quicker than others. It depends on supply and demand. I see the market in the northwest recovering quickly.

July 24, 2008 — 10:14 am

Vance Shutes says:

Tom,

A fabulous article full of great info for buyers. I especially like #6:

>”Don’t buy a house today if you aren’t going to stay there at least 7 years.”

I’ve typically used a 5-year window, so it’s helpful insight to look at it as you have. Many thanks!

July 24, 2008 — 2:00 pm

Very bad credit loan says:

#7 – Is it the right time for everyone to buy and sell? Nope, but I have the feeling that there are a lot of people sitting on the sidelines because they are scared of what the mainstream media has done to the portrayal of the markets and are missing out on some great opportunities to move forward and upward.

I could not have said it better myself. There is never really a good time to sell or buy a property. Ever now and then you see the mainstream media pushing the idea that if you want to buy a property “NOW” is the time or one must wait like for ever and sometimes it is the opposite. Like you said, if the buyers or sellers have professional realtor services and if they think frm investment point of view, they will always find themselves satisfied with the decision they made.

A very nice post indeed!

July 24, 2008 — 2:31 pm

Miami Real Estate Attorney says:

Great list and good points. The same advice regarding lenders applies to attorneys and Realtors–find somebody who knows what they are doing!

July 24, 2008 — 2:51 pm

Chris says:

Looking at it from an investors perspective I think its always a good time to buy RE. The only difference between now and 2004 is that its a bit harder to get money; but you have more deals to pick from.

Doesn’t matter if the market is going down, up, or sideways, a deal is a deal.

Unless your in MI or some other state thats going to hell. Here in CT we have it good compared to other parts of the country.

July 24, 2008 — 3:59 pm

Tom Vanderwell says:

Chris,

Vance and I are in Michigan.

Brian is in California.

I think you could say we’re all in the “hot zone.”

Tom

July 24, 2008 — 4:17 pm

John Sabia says:

Great points. #1 & #6 are tops for me, especially here in South Florida, where flipping was the buz word.

Fort Lauderdale Real Estate | Fort Lauderdale Condos For Sale

July 25, 2008 — 4:47 pm

Joey Martini says:

Great points, especially the one about “It’s a good time to buy a house” Because it really is. But there is a flip side to that coin, you need to have the money to buy a house. I mean that problem is middle class people are finding it hard to put in a house plan with all the problems with the prices, that are eating up our income. I really need to buy a house, and it’s the best time but I can’t afford it.

July 26, 2008 — 3:37 pm

Tom Vanderwell says:

Joey,

You’re right, that you need to put a house plan in place. I’ve had a number of clients who I’ve worked with who have set up a plan and we’ve worked things so that maybe now isn’t the right time, but if you take steps now, then maybe next year will be the right time.

If I can help, let me know.

Tom

July 26, 2008 — 9:04 pm