Do you want to hear my most perfect real estate marketing image? I’ve never seen this anywhere, except in my mind’s eye. It goes like this:

Do you want to hear my most perfect real estate marketing image? I’ve never seen this anywhere, except in my mind’s eye. It goes like this:

A little girl and her golden retriever are racing out the front door of their home. Why? Because “Daddy’s home!” – that’s why.

That’s it: Kid, dog, dad, with mom smiling proudly from the doorway. That’s The American Dream, circa 1955, but that is still the idyll we imagine when we think of home. It’s not simply a structure, not even merely a domicile. It’s Christmas and Independence Day, new babies and new puppies, tire swings and bedtime stories. Home is hope, the place where everything we love can thrive.

So tell me, if you can, what gives with Zillow?

Current tagline: “Home has never been more important.” That’s COVID FUD, I guess. The image is of a split-ranch home inhabited by vaguely visible people living widely-separated lives. I doubt anyone thinks that’s selling anything.

Recent tagline: “Reimagine home.” Say what? That dollop of word salad was intended to explain The Incumbent’s iBuyer business – by which Zillow reimagined profitability with a flame-thrower. The word “reimagine” itself has creepy Marxist connotations: As we have learned of late, “reimagine policing” turns out to mean “shut up or else!” Even leaving college-acquired SJW-ism aside, what needs to be “reimagined” about home?

So what did they have before that?

“Find your way home.”

And that would be simply perfect.

I Googled up old images with that tagline, and the photos are all pretty generic. But the tagline itself is beyond improvement: The aspirational quest is the literal function of the website. You simply cannot do better than that.

Why would they walk away from that? And why don’t they do a better job of selling that idea with images?

My takeaways? Billionaires are boobs. And marketing is for guerillas.

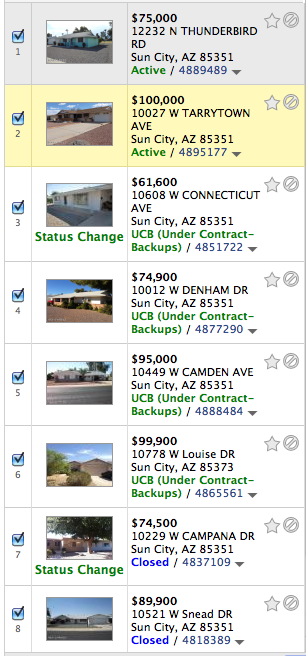

Who thinks this works as a landing page? [click the image to see it full size]

Who thinks this works as a landing page? [click the image to see it full size]

It has been 8 years since I have regularly blogged here. During that time I have learned a lot, broadened what I do, and instead of working as an SEO constultant, I am working full time as the Director of Online Marketing with

It has been 8 years since I have regularly blogged here. During that time I have learned a lot, broadened what I do, and instead of working as an SEO constultant, I am working full time as the Director of Online Marketing with

Do you want to hear my most perfect real estate marketing image? I’ve never seen this anywhere, except in my mind’s eye. It goes like this:

Do you want to hear my most perfect real estate marketing image? I’ve never seen this anywhere, except in my mind’s eye. It goes like this: