Note this from the Arizona Republic:

Mortgage rates around the country, which have been trending upward, dropped this week, offering a dose of good news for prospective home buyers.

Mortgage giant Freddie Mac reported Wednesday in its weekly survey that rates on 30-year, fixed-rate mortgages averaged 6.28 percent. That’s down sharply from last week’s rate of 6.37 percent, which was the highest in more than two years.

Newspapers are all about bad news reported on the shortest possible range of vision, so I suppose we should rejoice that the paper actually took note of some good short-term news. But the news of interest rates–and of real estate in general–is always about the long-term. The news of securities issues might matter day-to-day, but nobody buys a house one day and sells it the next.

So: What’s the real news on interest rates?

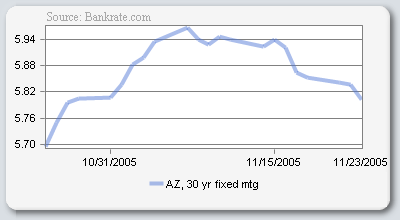

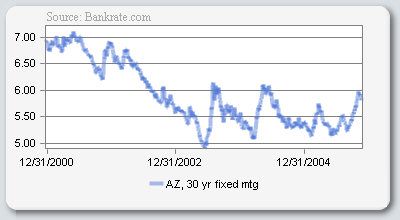

Take a look at this graph:

All of these charts come from BankRate.com. What we’re looking at is the average rates for a 30-year fixed rate amortizing mortgage from Arizona lenders over the last 30 days. We hover between 5.70% and 5.96%, and the recent trend is decidedly downward. Good news, huh? Maybe not:

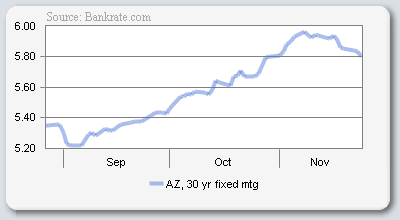

That’s the three-month trend for a 30-tear fixed. The real trend is fairly steadily upward, right? But wait. There’s more:

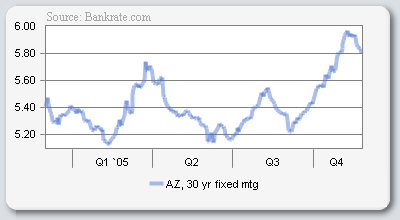

The same loan product over the last year. Down. Then up. Then back down. Then up a little. Then down a little. Then way up. Could it be that the sky really is falling?

Phew! The three-year trend looks like a Drunkard’s Walk, a random stochastic hovering right around 5.40%. Interestingly, the trend seems to be flattening. But: If you read anything into that, you’re making an error. Mortgage rates aren’t caused by trends, trends are a coincidental artifact of changes in rates.

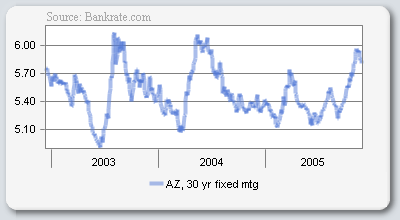

But here’s the real news:

That’s the five-year history of 30-year fixed rate mortgages in Arizona. Does that look like bad news to you? Does it look like bad news is lurking just around the corner, poised to strike?

Things can change. Disasters can befall us. Governments can inflict grievous errors on the national or international economy. But for now, at least, there is an Read more