Cited by BusinessWeek Online, a very eye-opening analysis of the sub-prime mess from National Review Online:

I’ve thought a lot about Rain Man over the past few months as I’ve been following the press coverage of the sub-prime mortgage crisis. The story’s been on the front page of the Wall Street Journal nearly every day. Pretty much every show on CNBC — except Kudlow & Co. and one or two others — has been obsessed with the topic. Yet no one seems to be asking the Rain Man question: “How big is the sub-prime mortgage market?”

And the answer, as Ben Stein makes clear, is not very big at all.

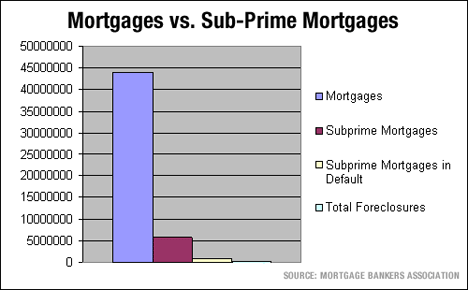

Currently there are about 44 million mortgages in the U.S., and less than 14 percent of them are sub-prime. And only about 13 percent of those are late on payments, with the majority of late payers working through their problems with the banks.

So, all in all, when you work through the details and get down to the number that really matters, only about 0.6 percent of U.S. mortgages are currently in foreclosure. That’s up a hair from roughly 0.5 percent last year. That’s it.

Actually, that’s not it. Things are actually better than the numbers suggest, since sub-prime-mortgage homes are less expensive than prime-mortgage homes. This makes sense. Wealthier people, generally, can afford costlier homes than less-wealthy people. The recent sub-prime surge brought large numbers of moderate-income families into the home-ownership market, and their houses are less expensive than most. Therefore, the dollar impact of the sub-prime default is smaller than if it were a prime default.

With approximately 254,000 mortgages in foreclosure at the moment — up from roughly 219,000 last year — the sub-prime meltdown has given us an increase of 35,000 mortgage foreclosures over the last quarter. Since the average sub-prime mortgage clocks in at almost exactly $200,000, we’re looking at an approximate $7 billion increase in foreclosed value in the first quarter of this year.

Raymond, how big is household net worth in the U.S.? About a hundred dollars?

Actually, it’s a lot bigger than that — about $53 trillion. In other words, the recent increase in sub-prime foreclosures amounts to 0.01 percent of net U.S. household wealth.

That’s toothpicks, Raymond.

Technorati Tags: real estate, real estate marketing

Robert Kerr says:

Your analysis is superficial. The total exposure goes beyond simple metrics such as active foreclosures and subprime composition of the total market.

The consequences have already spread beyond subprime and Alt-A.

By December, perhaps earlier, we will probably be in the midst of a full blown credit crisis here and in Europe.

August 10, 2007 — 4:31 pm

Chuchchundra says:

It’s early in the process yet. There’s a wave of sub-prime ARM resets coming up this fall. You’re going to see those foreclosure numbers come up dramatically. Check out my post here for the chart.

And sub-prime is just the canary in the coal mine. I’ve seen plenty of reporting on weaknesses in Alt-A and Prime territory as well. Not to mention all the happy homeowners who’ve tapped their equity, owe more than their home is worth and now have trouble paying the bills.

Maybe, all in all, it’s just a few percent of the outstanding mortgage market but that’s still a huge amount of homes being dumped into an already overstuffed housing inventory. Right now, things are just unpleasant, but they could get very bad indeed.

How bad? I’m not a bubble head psycho. I don’t think we’re headed for armageddon. But a lot of people are going to lose their homes. There’s going to be a lot of pain for lenders and borrowers alike and prices will come down, maybe back to 2003 levels.

August 10, 2007 — 4:33 pm

matt carter says:

Maybe another Rain Man question is: “Can I still get a loan, and what’s it going to cost me?”

NAR estimates that last year 45 percent of first-time homebuyers bought with no money down. Those loans are pretty much gone, and so are piggybacks, and the 2/28 and 3/27 loans that helped people with average incomes buy into pricey markets.

Rates on conventional prime loans are actually down a bit, but jumbos are hitting 7 to 8 percent, and Alt-A loans are getting up around 9 percent. Good luck getting a loan at any price if you are considered a subprime borrower.

“In three weeks’ time the clock has turned back to 1995,” Lou Barnes wrote today.

The liquidity crunch and tightened standards are going to put a crimp on demand and also lead to more foreclosures because people in risky loans won’t be able to refinance.

Loose lending often drives housing booms and tight-fisted lending makes them crash all the harder. At least that’s what the people who crunch the numbers say.

August 10, 2007 — 5:19 pm

Caleb Mardini says:

This goes far beyond subprime mortgages. The US economy has been running on mortgages for a number of years while very little real wealth creation took keep things going at the pace they were. Real inflation is much higher than reported as a result. Todays changes in credit markets will have far reaching effects.

August 10, 2007 — 5:23 pm

BR says:

Why is it that mortgage holders are not doing more to save the actual mortgage?

Seriously, they insist the loan be completely in default before they’ll even talk to the homeowner about maybe not foreclosing, maybe. Why not set up one time internal “owner bailouts?” create 100% principal payments or 100% interest payments (whichever works) for a set period of time? The way I see it, they have nothing to lose, right? Saving the owner credit in hopes that he or she can still refi in short order?

Interest on a loan not paid is zero, so why not salvage now and try to offset the blow?

I’ve never understood what is to be gainned by throwing away an owner who wants to pay, wants to stay, wants a chance…

The other question I have is would the fed reducing rates 1/4 reduce the pressure on the market?

August 10, 2007 — 5:27 pm

Chuchundra says:

BR, the problem is that nowadays it can be damn hard to figure out who to negotiate with. If the Jones family can’t make the mortgage payment, who do they talk to? When a loan had been chopped up into several risk tranches, bundled up and sold off into different MBS products, who is authorized to give the Jones a little relief so that they don’t go into default?

From things I’ve been reading, the answer is often, “Nobody knows.”

In the old days you’d just talk to the people who you sent your check to. Now, it’s most likely that that entity is merely handling the servicing of the loan and does not have any authority to grant any sort of relief or make any kind of deal.

So nobody knows what to do. The house goes into foreclosure. The Jones are out on the street and the bank gets another REO that they don’t want and can’t unload without taking a big loss.

August 10, 2007 — 5:48 pm

BR says:

Chuchundra, yeah, we experienced that trying to help an owner get out under a shortsale. We called for well over 4 months with 20 yes, 20 offers and not only did they put us off, send us around in circles, the owner actually fled to an apartment. We continued to work to get him out from under the loan and finally they decided two days before foreclosure to talk to us. There was only a 9k gap on the balance when it was all said and done.

I think we need to put more pressure on the service companies and insist they be allowed to make a call and start working with owners that want the help, if they do not want the help at the very least, establish shortsale departments and shortsale policy. The way I see it, it may very well be their last card to play in order to attempt to at least try to break even, and spread the loss evenly.

August 10, 2007 — 6:09 pm

Robert Kerr says:

The other question I have is would the fed reducing rates 1/4 reduce the pressure on the market?

I think it’s too late for that. Without the suicide loans that drove sales from ’05 onward, there’s no way to avoid the remainder of this correction.

August 10, 2007 — 6:58 pm

Brian Brady says:

Let’s be realistic here, folks. Greg does make a good point in this article.

How about we measure the homeownership rate in this country when the “crisis” is over? Will it be more or less than, say…2001 ? I think we’ll find that it is much higher.

While foreclosures are unfortunate, they are a byproduct of ANY lending cycle. This easy money cycle probably did a whole lot more good than harm.

August 10, 2007 — 9:28 pm

Staten Island Real Estate broker says:

The sub-prime mortgages are directly impacting other financial resources, such as stock markets, investment funds, and interest rates, among others. Anyone following news closely should know this by now…

August 10, 2007 — 9:38 pm

Jeff Brown says:

Brian – don’t go all rational on us now, because in reality we’re all about to be cast into the black abyss.

This is obviously a debatable topic. What I don’t get however, is how some folks over say, 50, haven’t learned what Dad taught me during the ’74/’75 recession.

In the bad or the good time the line on the chart isn’t headed that way forever.

Yet time after time that’s the way people think and behave. How else can folks be shocked by our current correction? How were people so surprised when we emerged, rather, exploded out of the horrible inflation/recession of the early ’80’s?

This correction will do its ‘correcting’ – then it’ll be done. And it won’t take forever either. But it will take the time it needs.

I don’t recall anyone predicting the mid-late ’70’s run-up; or the mid-late ’80’s boom; or the nearly 10 years of pretty dang good times just ended.

I do however, remember every single time we go through the ‘uncool’ part of the cycle, so many folks who should know better, begin the ‘woe is the economy’ chant.

We’ll be in pain until we’re not – then we’ll be normal. Then, in time, we’ll have some fair to middlin’ appreciation.

The point Greg makes is well taken. The number most observers can’t or won’t address is 1/100th of 1% that sub-prime foreclosures represents. That ‘rock’ wouldn’t make a significant ripple if thrown in a bathtub, much less an ocean.

If it was as bad as some would have us believe, there would be literally no buyers for the packages of these ‘horrible’ loans – the ones that are being bought (yes, at discounts of course) every week. If they were such a cancer there would be no buyers at 10&162; on the dollar – we all know they’re selling for far more than that.

I think what Dad was saying was, in good times don’t get such a swelled head, and in bad times don’t get your panties in a bunch. 🙂

The older I get the smarter Dad gets.

August 10, 2007 — 10:17 pm

John L. Wake says:

“”Interest rates on prime conforming fixed-rate mortgages eased further in the past week, according to the Primary Mortgage Market Survey, even though other sources such as HSH Associates reported that jumbo fixed rates increased by a quarter percent or more last week,” said Frank Nothaft, Freddie Mac vice president and chief economist.”

A tough news week but prime conforming rates EASED!

August 10, 2007 — 10:59 pm

Greg Swann says:

> Greg does make a good point in this article.

Note that I didn’t write this. I’m quoting from the National Review Online. The author is in his turn elaborating on a point made by Ben Stein. I thought the whole argument was interesting.

August 10, 2007 — 11:13 pm

MT says:

in a nation where 1/3 of the people are obese and 2/3 are overweight, it’s obvious that the majority of people will keep doing what they’re doing even though it’s bad for them. In the city I’m in, based on informal polling of title and mortgage professionals, MOST (70%+?) loans closed for purchase or refi over the last 3 years have been adjustable, even though any sane person planning to be in their house for at least 2 years would grab a fixed rate when they’re at well publicized historical lows. So I would agree that the sub-prime is the tip of the iceberg.

August 11, 2007 — 6:53 am

Jeff Brown says:

Though in many cases it might not have made a difference in the prudence of the decision, most borrowers opting for other than fixed rate loans were unable to afford the fixed rate payments.

The one thing that will come to the fore as time passes is the axiom – Lenders lend.

Combined with their sharp distaste for REO’s, and their insatiable need to push money ou the door, they will in increasing numbers offer ways for their borrowers to keep properties. They will also begin offering new loans with new terms until they find one that resonates both with borrowers and the secondary market.

It happens every time, and now will prove to be no different.

August 11, 2007 — 9:51 am

Brian Brady says:

“even though any sane person planning to be in their house for at least 2 years would grab a fixed rate when they’re at well publicized historical lows.”

That’s not a true statement. Historically, fixed rate mortgages fluctuate between 5.5% and 6.5%, going back to the 20s. The late 70s and 80s were an aberration. Fixed rates are at the high end of an historical range.

An inverted yield curve, historically precedes a recession. The ARM borrowers are getting savvy advice. Even better would be a convertible ARM, so a borrower could lock into a 5.5% fixed rate when they’re available (18 months?)

August 11, 2007 — 10:03 am

Chuchundra says:

That’s absolutely true, if by historically you mean “excluding the 1970’s, 80’s and 90’s”. Annual average rates were above 7% for almost all of that entire 30 year span.

Prior to 2003, when was the last time that 30 year fixed mortgage rates were below 6%? The Freddie Mac chart doesn’t even go back that far.

August 11, 2007 — 12:29 pm