Part V: Why arguments for the current method of compensating real estate agents and against divorcing the real estate commissions must fail

As I write this, the National Association of Realtors is preparing for its annual convention, to be held this year in America’s playground, Las Vegas, Nevada. This year marks the 100th anniversary of the founding of the NAR, so that milestone will be part of this year’s festivities. Can you guess what won’t be on the program?

You guessed it. Not one session or event will be devoted to an earnest discussion of divorcing the real estate commissions, reconfiguring the way we account for funds at Close of Escrow so that sellers pay only their own agents and buyers pay for their own representation. I think it would be accurate to say that the NAR likes things the way they are, but it would probably be still more accurate to say that divorcing the commissions is not even on the NAR’s radar.

Why not? That’s for you to decide, but the most common “yeah, but” objection you will hear to divorcing the commissions, among real estate professionals, is, “Yeah, but buyers don’t even care who pays the commission.”

I wrote this series of essays so you would know why it is important for the real estate commissions to be divorced. But assuming I have failed in this objective, let me endeavor now to help you understand why this matters:

In our current buyer’s market, some sellers are offering 4%, 5%, even 6% buyer’s agent’s commissions. Some new home builders are offering 8%, 12%, 16%. The highest buyer’s agent’s commission I have heard so far is 20%.

You as the buyer bring or borrow every dollar that gets paid to anyone in a normal real estate transaction, so it is possible that you could end up writing a mortgage check every month with twenty cents of every dollar going to cover what you unwittingly paid for “your” agent. That’s twenty cents of every dollar of principal payment, but also twenty cents of every dollar of interest — and taxes, and insurance and private mortgage insurance.

If buyer brokerage means anything, then it means that you employ “your” agent. But you do not employ anyone if you do not control that person’s compensation. If “your” employee can skim 20% of the value of your home behind your back, then “your” employee is a con-man and you are his mark.

And maybe that’s why the NAR doesn’t want to talk about this issue…

Here’s the way it really is: To defend that status quo — the seller allegedly paying the buyer’s broker’s commission as a split of the listing broker’s commissions — you have to defend it at its worst. Why would a builder offer a 20% buyer’s agent’s commission? To get that buyer’s agent to betray his own client. There is no other reason. And there is no other reason for any buyer’s agent’s bonus proffered by the seller or the listing agent. And, therefore, there is no other reason for any co-broke — for any payment flowing from the seller to the buyer’s representative. The seller is not paying to have his own objectives frustrated, and the listing agent knows all too well that paying a percentage of the purchase price as a buyer’s agent’s commission aligns the buyer’s agent’s interest with the seller’s, not with his own client’s interests. This doesn’t mean that the buyer’s agent necessarily will betray the buyer’s interests, but the deck is surely stacked that way, and it has never in the 100-year history of the NAR ever been stacked any other way.

We have changed absolutely nothing from the bad old days of sub-agency except for the field in the MLS form we use to offer the buyer’s agent’s commission. From my point of view, to defend our current compensation scheme is to argue for sub-agency in its naked essence.

And thus the arguments that we hear in opposition to divorcing the real estate commissions tend to be consequentialist, often very self-servingly consequentialist.

As an example: Divorcing the commissions will cause buyers to use the listing agent for the home they want, rather than a buyer’s agent. If we stipulate this, what’s the problem? If the buyers got what they wanted in the way they wanted it, whose ox is gored? Oh, it’s the would-have-been buyer’s agent, operating on the presumption that people buy and sell homes so that he can get paid. In fact, buyers need representation in order to find the home they want, to qualify for a loan, to negotiate the purchase, to supervise inspections and repairs, to marshall the escrow process, etc. If some buyers are able to handle some or all of this work on their own, then those people are being substantively over-charged by the way we do things now.

Another argument is that buyers are so completely infantile that they cannot or will not consider paying for representation. Recall that the listing agent’s compensation is almost always the first thing on a potential seller’s mind. And yet buyers, alike unto sellers in every physiological and psychological respect, just can’t catch on to the idea of paying for what they get. I think this is absurd, but, again, stipulate it. Where is the downside? People buy cars every day without representation. The salesperson works for the dealer, and no one is even pretending to be “your” representative. Could you get a better deal with professional advice? Would the value of that advice exceed its cost? That’s a tough question, isn’t it? Does a would-be professional advisor have a claim on a percentage of the price of your car whether you want his involvement or not?

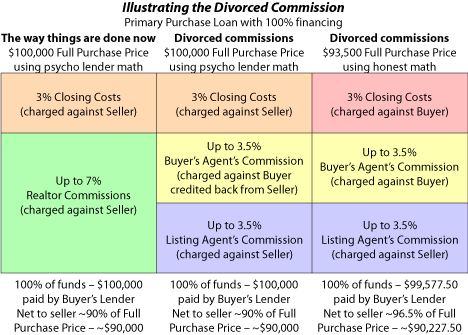

There is one argument I have heard that is at least worth attending to. Harken back to this chart:

The full purchase price of the home in column three is $93,500, where the same home would be valued at $100,000 in our current circumstances. In other words, in divorcing the real estate commissions, we could experience a one-time paper write-down in the evaluation of residential real estate of between 3% and 6.5% — a reflection of the buyer’s side of the parasitic marketing costs now speciously considered to be part of the home’s market value. This is a paper write-down, meaning it has no monetary consequence until a particular home is sold. Even then, the seller’s net financial results will be the same or even slightly more, while the buyer’s costs would be the same or slightly less. But even so, in order to stop telling lies at the closing table, there could be a one-time hit to the presumed paper value of American real estate.

Are the benefits to be realized from divorcing the real estate commissions worth the costs? I think so.

But what if you say otherwise? What else are you saying?

In Part I of this series of essays we discussed the reasons why the idea of buyer brokerage is in many respects simply a camouflage for on-going sub-agency. In order to endorse continuing to pay real estate commissions the way we are doing it now, I think you are endorsing the willful deception of home-buyers.

We talked in Part II about the many ways that the current method of compensating agents, and the systems built to support that method of compensation, infantilizes buyers, simultaneously deceiving them about who pays the buyer’s agent’s commission and deliberately withholding from them material facts about the biggest financial investment in their lives. Again, I think that to uphold this compensation scheme, you necessarily make yourself party to this systemic conspiracy of deception and non-disclosure, with the only alternative being the willful violation of MLS rules.

In Part III we took up the financial sleight-of-hand undertaken by lenders to justify paying real estate commissions and buyer’s closing costs as if they are represented in the value of the home, rather than being ancillary parasitic costs. We demonstrated how easy it would be to achieve the exact same outcomes without deception. In consequence, I think that to continue to advocate the present system of compensating agents, you would have to assert that it is in some way preferable or to the buyer’s best interest to tell obvious lies on the HUD-1 Settlement Statement, rather than expressing the flow of funds truthfully.

Part IV of this argument detailed all of the many benefits that will accrue to buyers, particularly, to their agents, and to the real estate marketplace as a whole, as a result of divorcing the real estate commissions. Not only can we eliminate the anti-consumer secrecy policy of the MLS system, we can build much more comprehensive inventories of home listings. On top of all that, the hostility and fear that have governed the so-called “co-operative” relations among real estate brokers will be eliminated from real estate transactions. And again, in order to oppose divorcing the real estate commissions, I believe that you are obliged to argue that not only are these many benefits not beneficial to consumers, but also that the many stark defects we have identified with the present system of compensating agents are not only not defects but are in fact even more beneficial to consumers that the benefits we have named here.

Finally, here in Part V, we have demonstrated everything this is absurd about arguments in support of paying real estate commissions the way we do now and arguments against divorcing the real estate commissions.

In fact, the most likely case to be made is that nothing will change. So far, the only interested parties are the real estate brokers, and their self-identified interest is to limit access to representation and to frustrate real competition even among real estate brokers in order to sustain the highest attainable price for real estate representation. Until consumers come to understand that divorcing the commissions is the only way to align the interests of buyer’s agents, especially, with their clients, the NAR will not reform itself from within. My expectation is that we will have to wait for either the DOJ/FTC anti-trust suit or some other court action to force a change. This is sad, since it means that the NAR will have assured its own irrelevance by failing to act for justice without being compelled.

Even so, by now we all know what is truly just in real estate representation. There are two or three other reforms I could name that would help to turn residential real estate into an honest business, instead of a half-camouflaged con-game constantly apologizing for itself. But the reform that will make the biggest difference, the most immediate difference and the most enduringly consequential difference is divorcing the real estate commissions, with the seller paying only the listing broker and the buyer paying only the buyer’s broker. If we can champion and ultimately enact only one reform to the real estate business, divorcing the real estate commissions is the one that matters most.

< ?PHP include ("https://www.bloodhoundrealty.com/BloodhoundBlog/DCFile.php"); ?>

Technorati Tags: real estate, real estate marketing

Spencer Barron says:

This is like reading plans for the next Rube Goldberg machine. 🙂 This is a great series of posts to outline the idea and while it seems well intentioned and completely justifiable, it still seems incredibly complicated and unlikely. Maybe we should all start with something a little simpler then build on the progress.

As it stands an agent could adopt these principles tomorrow and start working to implement this system in his business. It would only require a few simple changes on the purchase contract. Maybe it could be in a simple contract addendum. I’m sure there would be a few angry Realtors but in the end, it would come down to net to seller and cost to buyer. If your way is a better way for the buyer then I’m sure it would be greeted with wide acceptance by them. This might even become the standard practice eventually. Assuming the buyer understands any of this. I think changing the minds of a million real estate agents will be a lot harder than simply telling buyers something they already believe and using them to effect change.

Problem is that a buyer usually doesn’t understand that their agent isn’t always working for them. In addition, the buyer should understand that they will always be the customer in the relationship regardless of the label and thus need to educate themselves and ask questions. I think educating buyers might be easier than overhauling the entire system. If the FEDs want to get involved, instead of muddying up the works with more licensing and rules for agents, spend the money on education of future homeowners.

Second, I would work on getting everyone to understand that ALL commissions are negotiable and that should include what the buyer has to pay for his representation. Listing and buyers agents could begin working that into their contracts if they wished and even into the MLS. Co-op in the MLS could represent a maximum or anything you wish for that matter as long as it was disclosed clearly. We could at least get the ball rolling by disclosing the co-op to the buyers.

Baby steps.

November 11, 2007 — 6:21 am

abc@gmail.com says:

If I were buying a house knowing what I know now about commissions, I would negotiate a commission with the buyer’s agent that would be a set fee for representing me, payable either in installments through the process or at the closing when the deal was done. In exchange, I would make clear that any commission designated by the seller for the buyer’s agent would actually go to me.

If I’m the seller, there’s not much I could do given the way the market is structured.

November 11, 2007 — 8:46 am

Bob Wilson says:

I have read this more than once and still don’t understand the ongoing comparison to sub-agency. As a buyer’s agent in California my fiduciary duty is to the buyer, regardless of how the accounting says I’m paid.

November 11, 2007 — 5:57 pm

AL Sloviski says:

I have read it; I get it and now what? If I am a buyer or seller I want it. If I am the NAR I will never let it happen. If I am 80% of the Realtors I have no idea of what you are talking about. The 20% of Realtors that control the majority of contracts can take it or leave it.

The NAR is like an auto based union. They are not interested in competition or efficiency. They want bodies. Bodies pay union dues. If you add transparency, efficiency and competition into their model, you are toast.

GM is still in business and pays a bumper washer $80 dollars an hour with benefits. The union has held on almost as long as the NAR has been 6 percenting. Why would the NAR give up the golden goose?

Try and imagine a buyer that could not find a realtor to represent them. He visits ten offices and everyone is to busy to help. This could never happen with the ongoing system.

In your system (Witch I think is right) a buyer may go to an office and say he is only paying 1% he may not get any help but he might at 2%. He might hire the best in the office for 4%. This system kills the NAR.

The strong will survive. The average will get by and the weak are gone. This would probably cut out 35% of all Realtors. The NAR dues would decrease by 35% a year, the market would be more efficient and credible Realtors would prosper.

If you want to get something like this enacted look no further then lobbying congress. In some circles the NAR is the second largest contributor. It looks like your still going to see a bunch of broke Realtors fighting over 6%.

November 11, 2007 — 11:33 pm

Wayne Long says:

I don’t get the advantage to the buyer. How does it help him to come out of pocket with the other 3.5% or whatever the cost is? Why would I treat the buyer any differently because he was paying the commission rather than the seller? I get paid either way and want to find the house that fits the client. I really don’t pay a lot of attention to what the buyers side of the commission is in the mls. It is a nice bonus when it is 3.5%. I am not going to “betray my client” because the commission is 3.5% rather than 3%. JMO

November 12, 2007 — 5:15 am

Jeff Kempe says:

Great, great series of posts, Greg. Definitive. I hope everyone takes the time to read them all.

After my post on OAR I spoke to the OAR attorney apparently in charge of the $1.7 million special assessment dedicated to fending off (spurious) bad guys and promoting good guys. When I asked why we’d spend more money promoting what’s broken rather than fixing it, I mentioned divorcing commissions. She said “The business committee already has that under discussion.” Six months ago she’d have said: “Huh?”

So it’s coming; it will happen…

November 12, 2007 — 9:12 am

Bob Wilson says:

>”In your system (Witch I think is right) a buyer may go to an office and say he is only paying 1% he may not get any help but he might at 2%. He might hire the best in the office for 4%. This system kills the NAR”

Not sure that price equates to quality, but I’ll concede that point for now. Also not sure it kills NAR. What this system will kill is the big brokerage model that is profitable off the agents on the low end of the commission scale.

I’m beginning to like it. 😉

November 12, 2007 — 7:52 pm

Chris says:

Greg,

I believe I’ve found a new real estate company that is truly “divorcing commissions”, and as far as I can tell has been pretty successful. It’s called http://www.openthehome.com. They do a flat $2000 MLS list fee with a $1 co-op. They only represent sellers and are recommending buyers to seek representation from a real estate attorney as an alternative to using a Realtor. Their fee structure and ideas make this company good but I think the way they are doing it with their website makes them great! Check them out.

November 12, 2007 — 10:33 pm