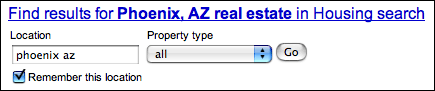

Do this: Go to Google and search for Phoenix, AZ real estate. We don’t compete for that term — we’re coming in like 34th place — but a lot of people do — like 3.5 million hits for the keyword without quotes.

Here’s what’s interesting:

Out of those 3.5 million search results, Google Base’s Housing Search comes first. That would be true for any other City, ST real estate search you might want to run. You don’t need the state if the search is unambiguous.

Yes, Google Base doesn’t have a lot of listings so far — only about 4.7 million. That’s twice as many as Zillow.com has right now, but it’s still not very many. The data sources are many and disparate, so it’s plausible that there are some duplicates in there, too.

And, yes, the search interface is horrible. It hasn’t changed much, if at all, in the past year. But who is willing to bet it won’t change in the next year?

For plain vanilla horizontal search — of practically anything — Google is god — omniscient, omnipresent, omnibenevolent. If you need more than plain vanilla horizontal search, you have to go vertical — but google wants your vertical real estate search to go vertical with them, too.

There’s more. The upshot of the DOJ/NAR settlement is that the IDX level of real estate search is likely to become ubiquitous. Right now, Google Base is limping along like Trulia.com and Zillow.com — partnering relationships with a few MLS systems, a few big brokerage chains, a few listings remarkers like flyer and virtual tour vendors, and direct entry by home-sellers and their real estate agents. That’s about to change as MLS systems, either directly or through IDX vendors or VOWs, make every MLS listing available to all takers.

If you’re Realtor.com, how are you going to hang onto an audience that can get essentially the same results from the same place they get all their other results — from Google.com?

If you’re Trulia.com — Realtor.com in pastels — what do you have to offer end-users that will be so much more valuable — a year from now — that people will click through from Google.com to reap that added value.

This is what I was talking about last week:

For example, it seems plausible to me that, over time, consumers are more likely to prefer real estate listings that are richer in information, as against those that are poorer in details. If this is true, by giving sellers and agents valuable incentives for improving its content, Zillow would seem to stand a much better chance of winning the battle for eyeballs in the long run.

This is not about Zillow versus Trulia, it’s about Google versus everybody. If the coin of the realm is simply the real estate listing, it’s all over but the shouting. Google will win. They will be able to deliver virtually all real estate listings, and they will deliver them to an audience that already goes to Google for everything. For pure horizontal real estate search, no one will beat the far-and-away market leader in horizontal search.

So the challenge for every sort of Realty.bot — and for every level of real estate and loan brokerage down to the individual practitioner — will be to offer so much added value that end-users will have the incentive to click through to a more-vertical page, when confronted with Google’s horizontal home search results.

VOWs like Redfin.com have the added value of being able to initiate and orchestrate the purchase of a home.

Estately.com offers significant added-value search results beyond those available in the real estate listing — itself by now a commodity product.

Zillow.com is building an end-user-extensible database of every residence in the United States — and soon Canada.

Trulia.com offers a number of social media options, as does Zillow, but I see nothing in the listings that Google will not be able to duplicate from the same basic commodity information.

Redfin and Estately have business models based on transactions — Redfin directly and Estately indirectly by referral fees. Zillow and Trulia — and the other VC-funded Realty.bots — are advertising plays. Like Realtor.com, Trulia.com depends on ad exposures and preferred-position fees. Zillow.com’s Mortgage Marketplace enables it to collect highly-detailed financial and demographic data, which may result in very high-profit advertising opportunities for the company.

But the question for all of the ad-supported vertical real estate search portals is simply this: Is your added-value proposition enough to induce home searchers to click through to your site — rather than another, or rather than simply using the information provided by Google?

John Cook’s Venture Blog picked up my post from last week on how the design philosophies of Zillow.com and Trulia.com affect content-creation by agents and home-sellers, and how, this, in the long-run, could make a huge difference how those sites are trafficked:

This disparity of quality of information and quality of contact opportunities is replicated throughout both sites. Zillow provides more opportunities for practitioners and consumers to connect, Zillow provides a much richer — and infinitely more link-rich — profile page. And Zillow does not “muzzle the ox that treadeth out the corn” by refusing to link back to the sources of the information it displays.

Both sites want practitioners to flesh out their content with on-the-ground details, but Zillow not only provides many more opportunities for doing so, it pays substantially higher link benefits for having done this work.

The link at the Post-Intelligencer brought out a slew of anonymous sleazoids who insist that Zillow has bought my integrity by sponsoring BloodhoundBlog Unchained. Calling me names is the favorite game of people who cannot reason or write well, but this really has nothing to do with Zillow. With the exception of Realtor.com — which can bleed Realtors white through their dues if it needs to — any one of the companies mentioned in this post could fail the test of the marketplace.

That’s not the question. The question is this: What test is the marketplace likely to impose? If the battle is purely over listings, Google will win it as soon at the MLS feeds get pumping and as soon as it beefs up its search and display interface.

If, on the other hand, people who are searching for real estate in order to sell or buy real estate are looking for more than commodity-level real estate listings, then the victors in the contest for those customers are likely to be sites that provide more of the added-value content or services that those customers are looking for.

We’re not fighting over access to the listings. We never were. The contest of capitalism is won by the vendor who provides the best value at the best price. And only in real estate could this be regarded as news…

Technorati Tags: blogging, BloodhoundBlog Unchained, disintermediation, real estate, real estate marketing, Redfin.com, technology, Zillow.com

Barry Cunningham says:

Greg …when I tweeted this I received basically NO RESPONSES…i looked around everywhere and saw no references or mentioning of it. Kudos for you basically breaking this.

Just another brick in the wall. You know I get villified for ever brining upthe subject but nonetheless if you can’t see the writing on the wall you are more than likley not looking.

Can there be any doubt that Google waited to see the outcome of the DO v. NAR lawsuit. Now the gates are flying open.

So many realtors thought the settlement was good for the NAR…and ignored the vital signs. Even ignoring this turn of events as no big deal.

Like animals in some long forgotten era who thought that light in the sky was no big deal. Turned out to be the comet that was an Extinction Level Event.

June 10, 2008 — 3:43 pm

Brian Brady says:

“Realtor.com in pastels”

That’s just funny

June 10, 2008 — 6:04 pm

Greg Swann says:

> “Realtor.com in pastels”

> That’s just funny

I thought I had slid it past everyone.

June 10, 2008 — 6:20 pm

Jim Rake says:

Greg – “are looking for more than commodity-level real estate listings…are likely to be sites that provide more of the added-value content or services that those customers are looking for”…..kinds of says it all.

You’ll have to forgive me, I’ve long been a guy that turns to the back of the book first.

As you indicated, consumers are looking to satisfy a need, and are increasingly better informed and are increasingly going “vertical” (in this case, it ain’t about size).

June 10, 2008 — 7:03 pm

Doug Quance says:

I have always considered Google the 800 pound gorilla hiding in the bushes. If Google really wanted to dominate the RE search market, it would be done. They have the money… and the present potential audience.

June 11, 2008 — 5:59 am

Joseph Bridges says:

Greg,

I agree that it is about more content rich information so I truly believe agents should focus on all other aspects except the listings since these other sites will provide that information. You cannot fight the 800 pound gorilla head on as one will lose. But all real estate professionals can focus on providing hard to find and niche information on neighborhoods and pictures of the area that are harder to come by then the listings and then direct people to their own MLS and listings on their websites. I see this as one of the best ways to build one’s own following (as the one here at bloodhound exists) to capture consumers for the future.

June 11, 2008 — 9:42 am

Dylan Darling says:

The internet real estate game will definitly go through more changes in the near future. Quality, unique, local content will help us remain a player in this game. Consumes want value at a local level.

June 11, 2008 — 9:45 am

G. Dewald says:

Hey Greg,

I made a post about this recently as well, but tried to focus it on ways for real estate pros to make use of it at the USM blog. I tried to frame it as listings-as-advertising on Google housing search because of the issues you bring up: Google will win any competition that involves having the best search functionality.

Also, the housing search doesn’t appear for any combination of city ST real estate (try stowe vt real estate for example).

One thing I noticed on reading your article is how it’s showing the search option to be for property type, in the ones I was seeing it was showing for bedrooms. The Google is A/B testing to see what is most important to searchers (and given their volume of traffic they’re going to know much quicker than anyone else–and by market and other variables as well).

June 11, 2008 — 9:48 am

Eric Blackwell says:

@G Dewald– Yes G-base is testing. They have been testing for a LONG time. My real estate site has been blessed to be #1 for city real estate as they have tested a number of the different scenarios including not having G-base there at all…no significant traffic loss.

Admittedly, they don’t have a ton of listings in our area …yet.

Greg, your point is WELL made…what DO they (interlopers) bring to the table in the face of Google?

Accurate Zestimates? Methinks not.

Trulia brings even less to the table.

(R.com in pastels…ROFL)

R.com (even the new version)…is just another list o’ listings.

Hell, even Overstock.com is now (poorly IMO) scraping listings…

The combination of VCs realizing this PLUS the need for some of these folks to start generating returns on the MILLIONS that they have spent in start up costs is gonna get interesting IMO.

In the end the customer will choose.

June 11, 2008 — 2:32 pm

Arlington real estate says:

There’s never been a better time to be a real estate blogger. And going forward it will be the optimal way to procure business. It lends itself to competing with the Big G and conquering the Big G in that “city, st real estate” is an atypical search for most visitors to a real estate website. I view all the keyword searches that led people to various pages on my site such as mclean va real estate and most of them did not use that combination (city st real estate). The overwhelming majority of arrivals had longer tail or more narrow searches.

Smaller markets will support a couple of excellent RE blogs and larger ones up to 10. But those bloggers will dominate RE search in general in the great majority of markets and will build dominating teams off of their blogs’ lead generation. Only now those teams will not be based on a superstar listing agent, but rather a superstar blogger with a witty, irreverent style.

Back to looking for a used surfboard….

jay

June 11, 2008 — 7:17 pm

Jacqulyn Richey says:

The rules have changed a little. Providing superior service and extras will be the only way grab the customer’s attention.

June 11, 2008 — 9:31 pm

Bob Wilson says:

Google wont be the death of the local sites, but as they improve their search, it will diminish the value of the national ones. If Google determines that consumers want more than just listings, they’ll add that as well.

June 12, 2008 — 7:51 am

jay says:

what are rules for reposting blog posts from bloodhound on our own blogs with credit/link to the original post/author? Is it allowed. Just thinking my readers might enjoy this discussion….

June 12, 2008 — 10:24 am

Brett says:

Brett Shaw for Cyberhomes.

No shock that Google is getting into listings. In the end, consumers are going to find the information that they are looking for. I personally use Cyberhomes.com to get information to my clients. It offers more than just listings. They recently re-launched with a combination of listings, valuations, and complete neighborhood analysis. Just plug in a neighborhood name, address or zip and you get all the information you would need.

June 13, 2008 — 12:04 pm