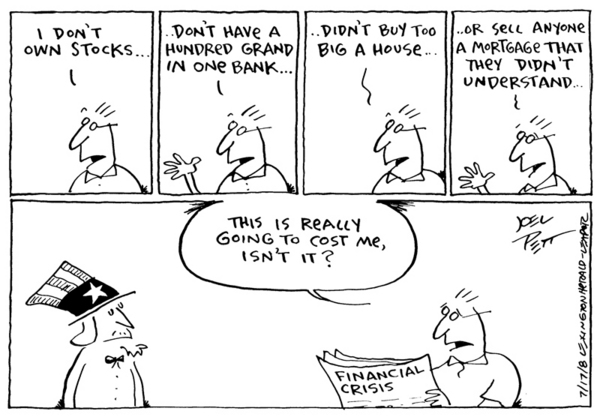

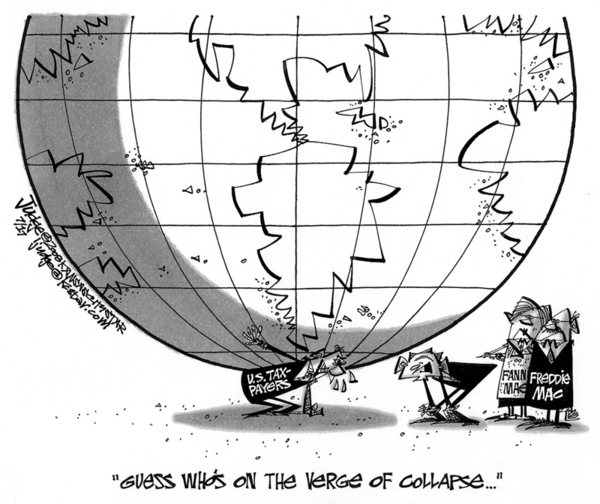

Barry Ritholz at The Big Picture had these two comics that brought to the forefront again the issue of moral hazard. Check out the comics and then we’ll talk “on the other side.”

Okay, now some thoughts about moral hazard:

The definition of moral hazard (as taken from that scholarly journal, Wikipedia):

Moral hazard is the prospect that a party insulated from risk may behave differently from the way it would behave if it were fully exposed to the risk. Moral hazard arises because an individual or institution does not bear the full consequences of its actions, and therefore has a tendency to act less carefully than it otherwise would, leaving another party to bear some responsibility for the consequences of those actions.

Let’s break that down and look at it a little more closely in light of the current market environment:

a party insulated from risk may behave differently…. What that means is that, frankly, the people on Wall Street and the bankers on Main St. (including yours truly) might very well have done things differently over the last few years if we had been more fully exposed to the risk. Will Fannie or Freddie buy it? That’s all that most mortgage lenders really cared about when structuring a loan. On Wall Street, the guys (I’m using that term in a gender neutral sense, okay?) who packaged these loans up and sold them as securities didn’t really care how they performed, all they cared about was the great big fat commissions that they made. The rating agencies didn’t care about whether they really told the truth about these mortgage backed securities, all they cared about was getting the big fat commission checks.

And so what do we have now? We have, between Wachovia and Washington Mutual, $10.1 billion in loan loss provisions in the last 12 hours. That’s for a period of 90 days folks. I was going to figure out the cost per day but my calculator doesn’t crunch numbers that big!

Moral hazard arises because an individual or institution does not bear the full consequences of its actions.

But how can we prevent a total meltdown of the housing and mortgage market (what would happen if Fannie and Freddie actually went under) without absolving some of the participants (for this particular discussion, we’ll limit it to Wall St., the Ratings Agencies, the Mortgage Companies, and the Banks who wrote the loans oh, and the mortgage lenders themselves if they did anything criminal or fraudlent) of at least some of their consequences?

Let me offer a few suggestions to start the discussion:

1. If the US Government has to step in to bail out any more financial institutions (aka Bear Stearns Take 2), the shareholders should get virtually no value for their existing shares. Years ago, I bought stock in AutoDie (a local die manufacturing company). It went bankrupt, I lost all $1000 that I put into it. (I know, big time investment). I know what you’re thinking – what about the FDIC and banks that fail? I’m not proposing a change in the way of FDIC, that’s going to continue to work the way it works and I’m all for that. I’m talking about the Bear Stearns, Lehman Brothers, Goldman Sachs type of investment banks.

2. If the US Government has to step in to bail out Fannie and Freddie, I think the only way that should be done would be for a couple of things to happen: 1) Existing shares should be turned into some sort of subordinated debt where the only way the shareholders would get any of their investment back is once Fannie and Freddie are paid back and they are turning a profit and then they would get back a nominal “dividend” until 5 years of profitability has happened. 2) The existing management along with their exorbitant compensation structure need to be shown the door (I could ruin Freddie Mac for a lot less than $20 million per year!) 3. There needs to be a 10 year plan put in place to eventually move Fannie and Freddie from GSE’s (Government sponsored entities) to totally private enterprises. It needs to be done but the market is too fragile to handle it now. That’s why I’m proposing a 10 year plan.

I know that there are companies who indeed are too big to fail, the economic devastation that would be caused by them failing would be significantly worse than stepping in to save them. But I’m getting the very uneasy feeling that the rally in the financial stocks that we’ve seen going on in the last week is being caused/encouraged/related to some sort of an “It’s going to be okay, because Uncle Sam is going to bail out Fannie and Freddie and that will save us from all of our bad investments and the world will be okay.

The world is not without risk, a lot of risk, but when there isn’t the consequences as well as the rewards for the risk, something has gone wrong. According to reports that I’ve read, this bailout could cost all of us $25 billion. We better make sure we do it right or we’ll all be paying for it for it for a long time and we better make sure things are set up so that the same risk without consequence issue doesn’t come back to haunt us again.

What do you think we should do?

Tom Vanderwell

David Shafer says:

Hmmm…is it moral hazard when a consumer gets a loan at 90% LTV or 95% or 100%? I mean they can walk away without suffering the consequences of that lost real estate value! Is it moral hazard when the tax code allows for tax deductions for mortgage interest and RE taxes? Is it moral hazard when a real estate investor gets tax breaks from the depreciation of RE? Is it moral hazard when workers depend on social security for retirement income? Or a defined benefit pension from the government or a company?

I mean the government bails out individuals all the time, and occasionally big companies.

The real question is are we going to forgive folks for their moral trespasses and are we going to forgive executives for theirs? Because the alternative is to allow all people [and companies] to fail and suffer the full brunt of their failure. Might want to read some Dickens for what that world looks like!

Not directed at you, but all this moralizing around the net is a little presumptous. People who live in glass houses should not be throwing stones!

July 22, 2008 — 7:45 pm

Dan says:

25 billion, that’s about 10 weeks of operating expenses in in Iraq….

July 22, 2008 — 8:27 pm

Tom Vanderwell says:

David – I know it isn’t directed at me, but I’ll keep the discussion going. I enjoy these discussions!

is it moral hazard when a consumer gets a loan at 90% LTV or 95% or 100%? – Nope, not if they can afford it. The consequences that they suffer if they walk away from the house are, just to mention a few, the embarassment, the fianncial ruin (try to get a credit card after being foreclosed on – want a car loan? I don’t think so). This does bring up the question of recourse vs. non-recourse loans but that’s a whole other story.

Moral hazard arises because an individual or institution does not bear the full consequences of its actions. How do the rest of your examples fall under the concept of moral hazard?

Where’s the lack of consequence for mortgage interest deductions? It’s merely a tax shelter that the government offers to encourage homeownership.

Where’s the lack of consequence for an investor to depreciate the real estate? If he holds it long enough, he’ll have to repair it, if he sells, he’ll have to “reclaim” that depreciation (note to readers – I’m not an accountant).

Where’s the lack of consequence that you cite for pensions and social security?

Because the alternative is to allow all people [and companies] to fail and suffer the full brunt of their failure.

David – I know you aren’t directing this at me, but if you read what I’m saying carefully, you’ll see that what I’m advocating is that any bailouts that need to be done (and I believe they will) must be done in a way so that those who made the investments as I mentioned don’t get off scot free. Does that make sense?

These are exactly the kind of conversations that I think we need to have so that people can understand a bit more of what’s being done in Washington right now.

Thanks!

Tom

July 22, 2008 — 8:29 pm

Tom Vanderwell says:

Dan,

I thought your estimate was high, but I did some looking and you’re right on with the numbers.

As we look at the consequences of actions, it raises the question of what would the consequences be if we pulled out of Iraq and the instability in Iraq plunged the middle east into more turmoil? (Can you tell my leanings on that subject?) 🙂

The whole concept of moral hazard and making sure that there are consequences for actions is quite far reaching.

Tom

July 22, 2008 — 8:52 pm

Thomas Johnson says:

Tom: The big numbers in the Fannie/Freddie bailout are the bond holders-70% of which are foreign. So a bailout of the GSEs would mean a bailout of our dear friends the Chinese Communists and the sweethearts that sold us our petroleum. If the Chinese Communist bond holders get a government guaranteed bailout, who is Washington serving- the taxpayer voters or the mortgage-investment bank complex?

July 22, 2008 — 10:07 pm

Dave Phillips says:

I’ll want to see some senior execs get canned or take a perp walk before I’m happy. Who in the world thought negative am loans were even remotely a good idea. While I think there are plenty of loan officers that were morally bankrupt during this period of stupidity, the senior execs who allowed this to happen should at least be fired. Other than a few that have been busted for mortgage fraud, no one is having to pay for this except the tax payers. I’m willing to pay, but only if I see Wall Street and Mortgage industry reps doing a perp walk. They could be cell mates with the folks from Fannie and Freddie.

July 23, 2008 — 4:33 am

Tom Vanderwell says:

If the Chinese Communist bond holders get a government guaranteed bailout, who is Washington serving- the taxpayer voters or the mortgage-investment bank complex?

Tom – that’s a good question that illustrates how difficult this mess is. What I’d like to see is essentially this:

Our reputation as a country financially stays intact (meaning the bond holders don’t get hurt, or at least not too much) because if they do, all government borrowings are going to get way more expensive and we’re too much of a debtor nation for that.

The shareholder in Fannie and Freddie get something for their money ONLY after we (the tax payers) get paid back out of the eventual profits from Fannie and Freddie.

No one on Wall St. makes any money on Fannie or Freddie (except again the bond holders -because if they stop buying bonds, the party’s over) until profitability returns.

Does that make sense?

Tom

July 23, 2008 — 4:55 am

Tom Vanderwell says:

Dave,

I’m willing to pay, but only if I see Wall Street and Mortgage industry reps doing a perp walk. They could be cell mates with the folks from Fannie and Freddie.

Very well said. I’m working on some more thoughts along that line that I’ll share with the gang in a day or two.

Tom

July 23, 2008 — 4:58 am

David Shafer says:

Tom,

Interest deduction and re tax deduction keep folks from suffering the full consequences of owning real estate. Its a government bailout of home owners, realtors, lenders, etc. Anytime you don’t have to suffer the full consequences of your actions you have moral hazard or as you put it the “full risk”. Would all these people have made the decision of home ownership if those government giveaways were not there or would they continue to rent?

There are consequences to the lenders and investors as we see right now. Just because the government might giveaway some $$$ to keep F & F from failing doesn’t mean folks aren’t suffering from losses. While we are at it what about the FDIC insurance? Another government giveaway to folks who make bad decisions about where to put their money! Moral Hazard anyone! And of course social security is a government giveaway to folks who failed to save/invest for their retirement days. Definate moral hazard there. When it comes to real estate and finance the government has been creating moral hazard for years by its policies. Most to individuals. That is the point that is missed by most folks. We should be very happy we have a government that will bail us out (and F & F). We should be very happy we have a government that honors home ownership enough to encourage it through the tax laws. And if you don’t think many of the loan programs were designed with the idea of increasing home ownership, had government approval, then you don’t really understand how Washington works. All this talk about perp walks is crazy (unless there was real criminal action). Why not have the 90% of retired folks who depend on social security to make it, do the perp walk for their failure??????

July 23, 2008 — 6:10 am

Tom Vanderwell says:

David,

I’m not sure I agree, but you raise some valid points. Let me discuss a couple of them….

Interest deduction and re tax deduction keep folks from suffering the full consequences of owning real estate.

Is that a government subsidy? Absolutely. However I think a case could be made that the only thing that would really change if that went away is the cost of real estate. Is it a bailout? I don’t see it as such.

Just because the government might giveaway some $$$ to keep F & F from failing doesn’t mean folks aren’t suffering from losses.

Very good point – I jsut hope that any giveaways as you term them are structured in such a way as to discourage this from happening again.

And of course social security is a government giveaway to folks who failed to save/invest for their retirement days.

If social security were something akin to medicare, and you had to prove that you were “indigent” before you could get it, I would agree. I’ve done mortgages for people who have invested quite well but since they have contributed into the social security system, they still get benefits from it.

When it comes to real estate and finance the government has been creating moral hazard for years by its policies.

No arguments there – that’s why I’d like to see a 10 year plan implemented that would start moving Fannie and Freddie out of the government sector and into the private sector. That would be a big help to the overall health of the housing market.

The difference between what I believe was a substantial amount of mortgage and investment fraud that perpetrated this mess and what you talk about in the retired folks is that it’s a crime to do illegal things, it’s not a crime to make stupid investments. Yes, some of what caused this mess was stupid investments, but a pretty substantial amount of it was beyond stupid and into illegal in my opinion.

Thanks for challenging me on this, it helps sharpen everyone’s thinking!

Tom

July 23, 2008 — 6:45 am

David Shafer says:

No doubt there was fraud involved. But, frankly don’t see it as the huge factor you seem to think. When it comes to F & F, it definitely was just stupid investments. They bought sub-prime and alt-a MBSs in 2003-2005. Dumb and the cause of the whole mess for F & F. How is that fraud?

Now if you are talking about consumers and originators lying about income and/or appraisers over appraising property, then that is fraud. But I haven’t seen any numbers to indicate this as being anything other than isolated cases. Option arms are dumb loans for both the consumer and the lender, but offering them is not illegal.

Are you conflating moral hazard with fraudulent activity?

My understanding of moral hazard is it is when folks don’t bear the full cost of their behavoir, allowing them to behave in ways that they wouldn’t dare to behave if the full cost was born. So social security allows folks to spend and not save/invest because if the full cost of their behavior was born it would mean starvation during their non-working days. Same with buying real estate, if the full cost of that was paid by the owners, then many would not choose to take the risk of ownership.

By all means punish fraudulent behavior, and the market punishes business mistakes pretty harshly, but to want to disembowel the entire mortgage market in order to make a point about government bailouts of business is counter productive at best and hypocritical.

July 23, 2008 — 8:57 am

David Shafer says:

Looks like congress is going to get rid of DAPs for the FHA program. Talk about moral hazard! Foreclosure rates 3 to 4 times as high. Pretty amazing that putting down 3% actually changes the way people think and behave that much!

July 23, 2008 — 9:10 am

Tom Vanderwell says:

David,

I saw that too. I’ve never actually done a DPA loan because for me it was always questionable at best and at worst outright fraud.

That’s a classic example of moral hazard!

Tom

July 23, 2008 — 9:24 am

Gayla says:

We need more realtors like you! Stick to your guns!

July 27, 2008 — 7:43 am