I’ve spent much of this month documenting how ineptly Redfin.com lists homes for sale. It wasn’t something I set out to do. I’ve been dour about them since I discovered CEO Glenn Kelman’s racist staffing policies, but I had never paid any attention to them with regard to real estate. They have mattered nothing to my business: I’ve never had a Redfin showing, never shown a Redfin listing.

But I was simply amazed by what I found. Just as with iBuying and the carrying costs of owning non-producing housing, every experienced broker knew that salaried agents would not produce. But even so, I was unprepared for what I found: Multiple bone-headed deal-killing errors in each listing, with those errors repeated in listing after listing. Since the MLS listing is the gatekeeper to showing and every succeeding step in the purchase process, if the listing repels the buyer, the home cannot sell.

And they don’t. Many listings Close over 90 days, some over 180. They have a lot of Cancelled and Expired listings, as well, with many of those at huge DOMs. Strangely, a significant number of these sellers relist. Having already lost six months and 20% of the property’s value, why not truly go for broke?

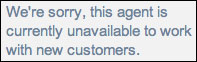

Oh. Nevermind.

And that would be the real problem. Redfin makes a point of not understanding real estate, so their plan is to recruit an agent who no longer exists – the top producer. The team leaders and rainmakers who actually sell homes are working at 95% to 100% splits – but the Read more

Redfin.com CEO Glenn Kelman is in Scottsdale today and tomorrow for the MLSCOVE Conference, a gathering of MLS executives from all over the country.

Redfin.com CEO Glenn Kelman is in Scottsdale today and tomorrow for the MLSCOVE Conference, a gathering of MLS executives from all over the country.