Should we say goodbye to the half-assed listing? Mike Price:

Today Buyside has announced an ABA, (affiliated business arrangement) whereby any homeowner can list a home in the MLS free of charge. It’s called IggysHouse.Com. Interesting branding, I couldn’t find anything on their site that explained the moniker. Could be they just got tired of searching for decent real estate domains, there aren’t too many left out there.

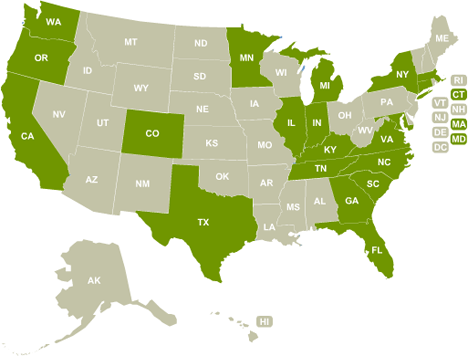

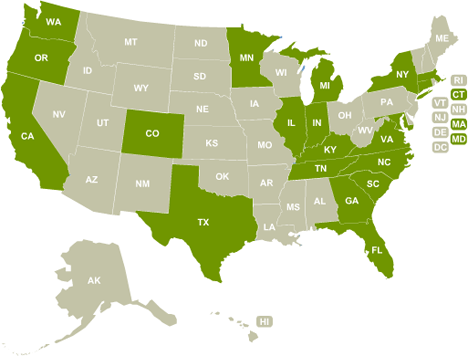

I went and looked for myself. Here is the Iggy coverage area:

Dark green states: Now. Light green states: Soon.

The site sells yard signs, lock boxes and forms, but not at huge premiums. I’m not going to fill out a listing to find out what happens, but my guess is that the end-user is doing every bit of the work for the MLS entry and the supplemental Do-It-Yourself web page with additional photos.

The Iggy people are promising listings on Realtor.com as well. As we have learned, Realtor.com listings do a lot better when they have virtual tours, so Mike might offer to make a video podcast at an extra cost, using PBS-style pan and scan video from the user-supplied photos.

Does this matter? In the age of the $99 listing, probably not so much. I truly don’t understand why there are any FSBOs left in the marketplace. If this doesn’t eat up the few holdouts, I’ll be amazed.

Interestingly, IggysHouse is evidently owned by BuySideRealty.com, which, apparently, hopes that, by giving away 100% of the listing commission it can cling to a whopping 25% of the buyer’s agent’s commission.

Are they daft?! No — they’re lenders. BuySideRealty is a lead-generation scheme that uses the real estate side of the transaction to rope in mortgage borrowers. And how much do lenders make? Just as much as they want to…

This is really quite a bit smarter than Redfin.com. They exploit the de facto “commons” in the traditional commission split, taking the buyer’s agent’s fee without doing the buyer’s agent’s job. BuySide is operating real estate brokerages as a loss-leader, to generate mortgage business.

Of the two, BuySide’s is the business model more likely to make a profit, if only because it has Read more

This one is called

This one is called  A relatively small company in Ft. Collins, Colorado,

A relatively small company in Ft. Collins, Colorado,