This is my column this week from the Arizona Republic (permanent link):

Fed trades a sharp pain, quick recovery for extended convalescence

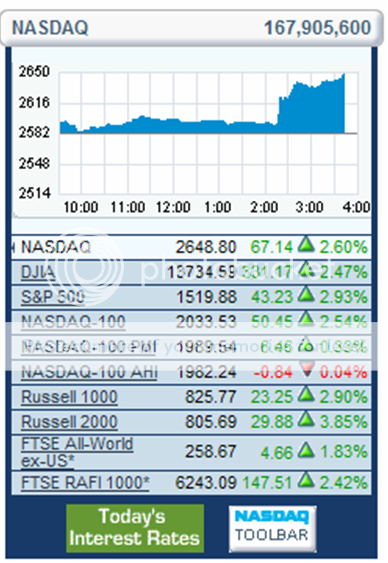

As I write this the Federal Reserve Bank just cut its federal funds rate and also its discount rate, both by half-a-percent. The Fed doesn’t control mortgage interest rates, but, for good or ill, it does have a powerful influence on every aspect of the American economy. These rate cuts send a very strong signal that the central bank intends to stave off any impending liquidity crisis.

So what just happened? We are almost certainly about to enter a time of financial distress — if not a recession then something very close to it. The nation’s central bankers have opted for a longer period of lower-level pain over a brief but very intense agony. It’s as if your broken leg were healing badly, and, rather than re-breaking the bone, your doctor elected to correct the defect with braces, weights and painful exercises.

Which would you choose if you had a choice — a quick, intense pain or a long, drawn-out recovery? It doesn’t matter. You don’t have a choice.

Starting with the dot.com collapse and accelerating with 9/11, the Fed has pumped the American economy full of money. To the extent that that money was wisely invested in increased productivity, it was well used. To the extent it was wasted, it will have to be redeemed — like a bad check hanging over your credit rating.

This is the financial distress we have to look forward to. Given a choice, you might swallow hard and live through that short spasm of agony. Instead, the Fed’s action this week may turn a short-term crisis into a long-term syndrome. Rather than re-breaking the bone, living through the healing and getting back to work, we could be spending the next few years on financial crutches.

On the plus side of the ledger, mortgage rates should go down in the immediate future. It remains to be seen if this will bring buyers out, but this may turn out to be an opportune time to refinance mortgages or home-equity lines Read more

The weather broke “officially” last Tuesday. I could see it in the quality of the light, but we had lingering humidity from a Gulf hurricane. The last of that fell as rainfall on Monday afternoon, and by dusk it was obvious that the Arizona Monsoon was over.

The weather broke “officially” last Tuesday. I could see it in the quality of the light, but we had lingering humidity from a Gulf hurricane. The last of that fell as rainfall on Monday afternoon, and by dusk it was obvious that the Arizona Monsoon was over. Inasmuch as we are living through the nightmare of Proposition 2, one might think we could learn a lesson. We won’t, and every eye was on the Fed this afternoon.

Inasmuch as we are living through the nightmare of Proposition 2, one might think we could learn a lesson. We won’t, and every eye was on the Fed this afternoon.

This week’s Odysseus Medal goes to Dan Melson for

This week’s Odysseus Medal goes to Dan Melson for