Bailout. Stimulus programs. Health care. Subprime. There are lots of problems, or as one of my mentors would say, lots of “opportunities.”

Which Presidential candidate “gets” the subprime fix in which we find ourselves? Great minds must think alike, as Jay wrote about the subprime issue yesterday.

We need a leader who will have the integrity and boldness to do nothing – let the markets sort themselves out. Artificially delaying the inevitable? Great idea.

60 Minutes did quite the story this evening on the subprime problem, summed up with this quote:

“An invitation to fraud … they are being paid not by the veracity of the information but by the consummation of the deal.” … “It would never end; except that it did.”

The economy, not just the American economy, but the economy – the worlds’ economy, is broken.

Excluding all other issues – military, social, international – and focusing on economics and the subprime problem specifically, which of the candidates in the never-ending saga known as the race for the Presidency?

Might it be this one?

“If you believe in free enterprise and capitalism,” (he) said, “you should have the market forces determining interest rates.”

It’s the distortion of interest rates by manipulating the money supply that causes bubbles, like the one in housing, to form, he said, and rarely does the Fed take responsibility when these bubbles burst. “They’re not held accountable,” even after the “total chaos” of the past year.

What do you think? Which one do you trust the most; which one do you mistrust the least?

Where do we go from here?

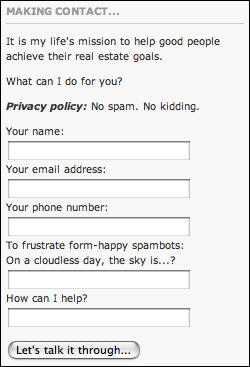

What I came up with is a sort of universal contact form for real estate webloggers.

What I came up with is a sort of universal contact form for real estate webloggers. What if somebody built a Realty.bot that seemed to make sense from Day 1? What kind of goof-ball strategy is that in the wacky world of Web 2.0?

What if somebody built a Realty.bot that seemed to make sense from Day 1? What kind of goof-ball strategy is that in the wacky world of Web 2.0?

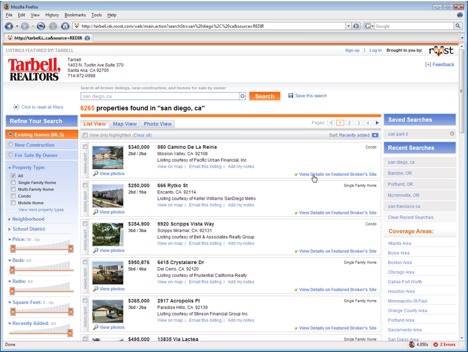

Yawn! YAMBS again? That’s Yet-Another-Map-Based-Search, a transition in the course of two years from the cool to the commonplace. I haven’t been able to play with Roost.com yet, but my guess would be that they’re behind the curve on cool-factors. The search tools seem to be more than adequate, but Roost is all about search, with none of the social-theater-of-the-mind games the older Realty.bots have been rolling out.

Yawn! YAMBS again? That’s Yet-Another-Map-Based-Search, a transition in the course of two years from the cool to the commonplace. I haven’t been able to play with Roost.com yet, but my guess would be that they’re behind the curve on cool-factors. The search tools seem to be more than adequate, but Roost is all about search, with none of the social-theater-of-the-mind games the older Realty.bots have been rolling out.