For Teri, just because it jumps.

Month: August 2008 (page 3 of 6)

I don’t hide my admiration for Louis Cammarosano. We “met” first on Active Rain, last winter. Louis noticed a comment I made about how third-party lead generation companies weren’t inherently evil and invited me to be the inaugural “expert blogger” on the HomeGain Blog. I thought Louis would transform Home Gain from a Web 1.0 leads aggregator to a Web 2.0 platform, with a suite of online marketing tools for agents.

Louis hasn’t disappointed me.

HomeGain releases it’s “Agent View” service tomorrow morning. From the press release:

AgentView connects HomeGain visitors with its real estate agent members by showcasing useful real estate content alongside prominently featured local real estate professionals. Visitors can view agent listings, agent profiles, agent blogs and local information. Visitors can also get an instant home valuation estimate from HomeGain’s home valuation tool or use Home Sale Maximizer™ to determine which home improvements will best help increase the resale value of their homes.

In short, Home Gain is allowing its agents to add featured listings to their “blog homes” and providing useful valuation tools for the consumer…that keep the consumer on the agent’s page. What’s this mean to you, the agent who may be on the far right-hand side of the learning curve? Probably nothing…for now.

What is DOES mean is that HomeGain is unleashing a RE 2.0 platform to its customers. As some 5000 customers connect with consumers , from the powerful HomeGain site, their listings, blog posts, and profiles will get some legs in the SERPs for their particular keyword search terms. We’ve seen Trulia, Zillow, et al dominate the SERPs and challenge the individual practitioner’s RE2.0 efforts. Now, the 800 lb gorilla could be an army of HomeGainers throwing content off of a Google PageRank 7 site.

At $40-$50/month, the tool is affordable enough for the novice to “get engaged” in the interactive web evolution. Why would anyone pay for a blog when WordPress or ActiveRain gives it away for free? Results. HomeGain is, in my opinion, a traffic wholesaler. Through SEO, SEM, and affiliate marketing they drive a heckuva lot of TARGETED traffic to its site. The Read more

I think most of us can agree that real estate agent, as a profession, lacks “street cred”. The reputation for our industry is not high and I say this despite the reputable people I meet here and elsewhere. Two ways to effect a change in that perception are: raise the bar of competition and adopt a better model. Sometimes we can do both.

In a recent post called It Takes More than Comps to Beat the Competition, I introduced a pricing model based on how assets are valued in the securities industry. As a former stock broker and options trader, I can tell you that the methods employed in the real estate world for valuing assets and advising clients are rudimentary. A more thorough understanding of what a property is worth and a framework for better understanding what that knowledge suggests would not only help us to do our job better, but it would separate those that use the tools from those that do not. Adopting a better model de facto raises the bar of competition.

A Quick Primer

From a securities standpoint, price is rarely the sole motivation behind a buy or sell. We are usually trading volatility or time or both. An asset’s value then, is affected by these two items. This is evident in real estate too. Good agents take these factors into account when they do comps, but we are generally lacking the common language and function for applying them. By adopting a better model, we gain these tools.

Volatility

Let’s use options as an example: an options contract is valued in relation to the underlying stock. This valuation is called its delta. On a scale of 1-100, a delta of 100 means the options contract might as well be stock. It is traded, hedged and valued as if it were the underlying stock. A delta of 20, on the other hand, means the options contract is very unlikely to approach the value of its underlying stock. It has only a 20 percent chance of holding value. I would therefore trade, hedge and value it quite differently. Now a delta Read more

This started as a comment on Jessica’s earlier post about content. Welcome aboard, Jessica, and thanks for the grist.

Jessica points out that the average agent is no better than the average owner at generating content. I disagree with that a little: FSBO listings with owner-generated content are often better than agent-generated content (which isn’t saying much).

Owners just know more about their property and its surroundings, have more at stake, and have just one listing to worry about. Not to mention that, if they are even going the Web-based FSBO route, they know their way around a computer and the Web and are more likely to be an educated professional in their own right. All they really need to do is develop the content they know they would like to see themselves.

eCommerce professionals know that content sells. Period. Just compare the quality and depth of content Amazon has around a $10 copy of Home Buying for Dummies to the average listing for a $500k ranch on Realtor.com. The only thing I’ve seen that plays in that ballpark are Greg’s single property Web sites.

The current model (agent responsible for everything, gets paid nothing unless they sell), has Zero capacity for generating consistent, quality content that consumers are accustomed to when they buy anything else on line, and that violates the most basic principle of merchandising: Use the consumer’s learned behaviors to encourage them to do what you want them to do (like contact you).

So how do you change that when the entrenched interests have a dis-incentive to do the right thing? To wit:

- Agents don’t want to dip into their split to pay professionals.

- Brokers take advantage of the indie contractor tax loophole to make sure they don’t have to pay agents in the first place, and even the very best admins (the people who really keep the wheels on in every RE office I’ve visited) make, what? $30/hr.? That is not a mindset that is conducive to paying specialists.

- The NAR and the MLSs have a stake in keeping the agent population over-stuffed with dues-paying half-wits.

- The franchises consider consumers secondary customers: Their majority of their Read more

Still needed is regulation of yield-spread premiums — cash rebates paid to third-party brokers as a kind of reward for funneling unsuspecting consumers into higher-rate loans

-Rich Cordray, Ohio Candidate For Attorney General, Demonstrating for the record his utter lack of understanding of how real estate financing works.

That is in my inbox. Enough to make any broker mad. And, while I’ve responded to the industry requisite “spam your congressman,” and occasional political action calls, I have never been as ready to fight as after I was reading that. Cordray enjoys a congenial reputation, but I can’t stand willful ignorance.

Rich Cordray is the anointed Democrat who is in line to succeed disgraced (also Democratic) Ohio Attorney General Marc Dann (the link is precious). There is a Republican running, but he’s even referred to himself as the sacrificial lamb of the Republican party.

This email was sent from my friend Jeremiah. One of his small “l” libertarian buddies, Robert Owens got drafted by the Ohio Liberty Movement. Would I pitch in to stop the madness? Would I give my time energy and effort to a longshot race? Hell yes.

I’ve regarded politics as an onastically futile pursuit, someone must do something. And I’ve got the time, the interest, and hopefully, the acumen. I’m responsible for creating a social media and blogging plan to raise enough money to compete. We want our electorate to be especially cognizant of the anti business positions of our candidates. Oh, and the candidate? His biggest issues are following the constitution, and having transparency in government.

So, I’ve got a few weeks (80 days, which is 11.4 weeks) to come up with a plan to get enough money to be viable, to get the funds to keep our professional campaign staff in the hunt, and to fight, fight, and fight some more. Can I successfully apply the lessons I’ve learned over the last 9 months to this fight? All eyes are on me as I’m the one Read more

OK, boys and girls it’s Pop Quiz time!

Quick, without beautifying your answer, be honest and name one of the normal pickup lines a Realtor® would tell a FSBO in order to get their business? This one comes to mind:

“If you let a professional sell your home, you will walk away with more money.”

IF, that’s the case (third class condition, maybe it is and maybe it isn’t depending on the agent, property and market) then why are Realtors® so darn stubborn about following their own advice?

Is it that we have to do everything ourselves? That we can do it better? Faster? Cheaper? What drives this mentality? Since when did passing a multiple-choice examination on specific real estate matters make us omniscient about all things under the sun having to do with marketing and selling homes? I’m not being overly critical. I’m just asking. I believe it’s a very fair and valid question.

For Example:

Photography: Sure, I own a digital camera and have taken hundreds of pictures of my family. That doesn’t even begin to qualify me as a professional photographer. I’ve read a few things about lighting and the rule of thirds, but I’m still not an expert. I’m experienced enough to be dangerous. And that might not be a good thing for my client. You know what they say, “A picture is worth a thousand words.” Well, I’m being paid thousands of dollars to make the photos speak to buyers. Maybe an expert could help more accurately express what needs to be said through them? Just a thought…

Video: Yes, I own a flip camera and Jason has a $5,000.00 Sony pro-consumer video camera that he loves to play around with. He has filmed videos of the kids opening birthday presents, Brutus jumping into the pool, and many other wonderful and exciting things (don’t even go there). But Peter Jackson making Lord of the Rings, he is not! We’ve always hired a professional for any project that wasn’t just for our enjoyment. A video of your client’s home Read more

I can’t swim; not a lick, stroke or otherwise. I got pulled out of the deep end for the first time when I was 4 years old and then again when I was 14. Both times I saw my quick, up-to-that-point-in-time life, unfold before me as I flailed wildly for help, until finally sinking below surface and fading off into the ether…. Both times I awoke choking up chlorine with a male lifeguard’s mouth on my mouth trying to breath life back into my waterlogged lungs. Both times I was left with the taste of stale cigarettes. I didn’t turn out gay but I did become a smoker soon after the second incident; luck of the draw, I suppose.

I was clocked in the 100 Yard (not meters) Dash under 10 seconds in the same, much younger life, but I never gave anyone reason to save me from myself in that particular venue. I was, unfortunately, forced to run the last leg of a Mile Relay once in high school and hit the asphalt pavement, face first, on the third turn. I had to be escorted off the track and into the infield by the cheerleaders, one of whom I did bum a smoke from, so I suppose the theme continued on in its own way.

I’ve never put on a gymnast’s uniform (okay…maybe once after a heavy night of tequila shooters in Tijuana, circa 1984) so there’s nothing really exciting to report on that Olympic front, either. I don’t do horseback riding, play basketball worth a damn, or participate in soccer, softball, or syncronized anything; men, womens or Soviet Block cross-gender. I don’t do long distance unless it’s covered in my AT&T plan.

I did ride my bicycle 23 miles yesterday morning—but it took me almost 4 hours, well off any competitive pace, so it’s probably not even worth mentioning here. Oh, and I did get into a boxing match of sorts one night with someone who may very well have been a ladies weightlifter from Azerbarijan but that ended in a ‘no decision’ from what I’ve been told. As I vaguely recall, Read more

As real estate agents we are always looking for ways to help our clients make sound decisions. If we find a way of doing so that also differentiates us from the market – all the better. In the next two posts I am going to share a new way to value property that not only gives clients a vastly superior ability to make home-buying decisions, but should decrease defaults and foreclosures substantially too. Do you think that will make me a better agent? More valuable? Here’s one more way to differentiate yourself in the marketplace of real estate agents. (Warning: this post and the next involves some arcane securities concepts and new ideas that will require even more of your time and effort. If this does not interest you, stop reading now. Pick up a newspaper. Enjoy the classifieds. Maybe polish up the old resume…)

CMAs

In a recent article by Greg Swann discussing the woes of the real estate market, he mentioned homes selling for less than they would cost to build. He referred to homes priced “below their fundamental value.” Over the past six months or so I have been discussing with Brian Brady different ways to value a property. Having both come out of the securities field (I was once a securities broker and “enjoyed” some pretty exciting… read: stressful… years as an options trader on the exchange floor), the discussion revolved around how property would be valued if it were a security investment. First, Comparative Market Analysis or CMAs would be used only as a qualifier or a secondary validation. They are circularly self-serving and relationally compromised. Instead of “comps”, let’s wow our clients, protect them and increase our value as agents at the same time.

A New Way to Value

Remember I warned you that this would involve extra work. That is because there should be four values to any property and they should all be calculated before we advise our clients. Here are the four values in ascending order:

- BREAK-UP VALUE – this is the value of the land itself along with any profits Read more

That’s Kodak’s brand new Zi6 hand-held video camera. If it looks a lot like a Flip camera, there’s a reason for that. At first glance, it’s a virtual Flip cam clone, right down to the built-in USB connector and the YouTube video-sharing software.

That’s Kodak’s brand new Zi6 hand-held video camera. If it looks a lot like a Flip camera, there’s a reason for that. At first glance, it’s a virtual Flip cam clone, right down to the built-in USB connector and the YouTube video-sharing software.

And like the Flip camera, the optics are nothing special. This is not a camcorder, much less a pro-quality video recording device. This is a hand-held solid-state-memory camera meant to be used to capture memoranda, video podcasts or embarrassing moments at parties.

The Kodak version of the concept stands out from the Flip, though. For one thing, it’s pretty costly — $179.95 list. Much worse, while it can handle SDHC memory cards up to 64GB (which could equate to a day-and-a-half of continuous video), it actually ships with nothing but its own on-board memory. After overhead, there is 30MB left for video — not enough for a sustained belch from a practiced teenager.

By contrast the Flip Mino lists for $179.99 but ships with 2GB of memory — 60 minutes’ worth. The Flip Ultra lists for $149,99 and ships with the same 2GB. Both the Kodak and the Flip Mino use a rechargeable battery scheme. The Flip Ultra uses AA batteries, which is by far preferable to me.

Where the Kodak pulls away from the pack is in video quality. The camera can shoot 720p HD video at either 30 or 60 fps. A short lens and lots of camera motion, but better-than-TV-quality video. Go figure. More significantly, Kodak claims that H.264 is one of the native capture formats for the camera. That’s QuickTime, folks, the MOV format. That implies on-board hardware compression, which would make clips from this camera wicked easy to edit in Apple’s Final Cut video editing software.

YouTube is pretty strong on compression, so my thinking is that a YouTube video from the Kodak Zi6 (dumb name; it’s not a German roadster) is not going to look much better than a YouTube video from a Flip camera. But if you’re shooting hand-held video to be edited with high-end software, it’s plausible that the Zi6 could save you a boatload Read more

I wrote a PG-13 rated post about 10 months ago about a few sites that only had links to each other (grin), but rather than point at what not to do and be negative and all that, I would like to throw out some (possibly) new thoughts and ideas on building online authority.

WHY NOT BE HYPERLOCAL ABOUT IT AS WELL AS REALTOR TO REALTOR??

Good SEO requires effort at building online authority (read: LINKS from other sites into yours). It was the basis of how Google’s algorithm was founded. Simple as that.

Great SEO builds authority and relationships (and PROFITS) and take links into SECONDARY consideration, but finds creative ways to do it in a DEFENSIBLE way that others cannot match, duplicate or replicate.

I don’t find it strange that MUCH of today’s REALTOR online authority (links) are built like a referral network from REALTOR to REALTOR. It is the most efficient way to build authority that Google would recognize.

But if you REALLY wanted to impress the search engines, why wouldn’t you build LOCAL online authority ? This means that you would be able to bring much of the chamber of commerce to recognize YOU as the real estate authority. They would link to YOUR blog or YOUR site. If they link to you because they know you, or you have done something nice for them, why wouldn’t they REFER you to their friends?

That would bring BUYERS and SELLERS to you as well as links! It would be true authority IMO.

I DO find it strange that less REALTORS use THAT approach as well as vying for respect among PEERS.

I have prepared some specific techniques and ideas on this subject for the REW conference in September, but IMO the specific techniques are NOT AS IMPORTANT AS STARTING WITH THE RIGHT GOAL. THE GOAL IS TO BUILD ONLINE AUTHORITY AND EXPOSURE AMONG YOUR CUSTOMER BASE AS WELL AS YOUR PEERS. It is about a diverse and defensible reputation. (And a cash flow POSITIVE one (from referrals) as opposed to paying others for links). In my opinion, it is not just about seeing how many peers Read more

Who wants to be a volunteer?

I received a very pleasant courtesy call the other day from a Realtor who represents a property that I showed to my client several months ago. After showing this particular property, my client and I both walked out of the showing stating that the seller obviously wasn’t reading the news – what were they smoking? Nice but over priced – NEXT!

Her upbeat message was hard to resist,

Volunteer Agent: “Hi Tom, I’m just touching base with all of the agents who’ve showed my listing in the past that my seller is now offering a 4% co-op on the sale of their property, is your buyer still in the market?”

The property in question is still listed with no price reduction.

Me:”Thanks for the call – nope, my client is no longer in the market – they’ve since made a decision, purchased and closed on a more realistically priced property.

Volunteer Agent: “What do you mean a more realistically priced property?”

Me: “Um – (wondering if she was serious) a property that is realistically priced???”

I guess from the nature of the call, her question perhaps was not necessarily a surprise. I thought that my response was fairly understandable – realistically priced means realistically priced, right? Needless to say her tone became a tad indignant.

Volunteer Agent:”Well – as you can see from the co-op commission, my client is very motivated to get this property sold!”

Me:”Yep – sounds great – the motivation is clear – thanks for the call.”

Volunteer Agent:”Ok – well, thanks again and keep it in mind.”

Yep – I sure will keep it in mind – next time I want to get paid for convincing my buyer to overpay for a property that doesn’t clearly reflect market conditions, you’ll be the first agent I’ll call. Hurray for me! I gonna make a killing!

There is nothing I love more about selling real estate than not getting paid for doing my job! I love volunteering! I honestly believe that one of rewarding aspects of being a real estate volunteer is not sharing the facts about the Read more

Last Tuesday I met with a potential real estate investor. She’s an investor because she’s got the money, the credit and the will to dip her toe in the water. She’s a potential investor because she has never yet been a landlord. That’s okay. I’ve worked with many potential investors, some of whom have gone on to own multiple properties, most of those — not all, alas — very successfully.

Mostly when I do these kinds of interviews, I talk about premium suburban single-family rental homes. This is normally the safest and most economical way to start a real estate investment plan in Phoenix. This is especially true right now, when the right rental home will be cash-flow positive from day one. Our rents are low but stable, and our home prices can be very low right now.

But I also talk about other income opportunities in real estate, if only because land-lording is not for everyone. I would not advise a first-time investor to take the plunge in a large multi-family community or a strip mall, but there are plenty of other ways to take advantage of our current market conditions.

An example? Flipping. Never was heard a more discouraging word right now, but flipping has a horrible reputation because ten bazillion TV-tycoons bought at the top of the market and sold their refurbished masterpieces at auction. Now, when entry prices are low and trending lower, a slow flipping strategy promises nice rewards.

Here’s one slow strategy: Find a great flip candidate at a rock-bottom price. Buy it to own as a rental, doing what you have to on the way in to make it marketable as a rental. Hold it in that state — with the monthly cash-flow covering your costs — until prices recover to your satisfaction. When the tenant’s lease expires, do the refurb and sell.

Here’s another one, a strategy that worked very well from 1997 to 2006: Buy your cheap refurb candidate and move into it. Redo the home slowly, room by room, especially when the materials for doing a particular room are very cheap. Sell it after you’ve owned Read more

Owners, brokers, exalted ones lend me your ear! Today is the day to become students of history. To learn from mistakes made in the past. Does the royal library lack history books? Send out the servants to fetch them! The servants are busy on other important affairs of state? Perhaps, while exhausting yourself with strenuous retail therapy or the daunting task of where to holiday next, you could swing the golden carriage by the Barnes & Noble bookery? It will only take a minute, Sire. Books written about the French Revolution or the American Revolution would be a good place for his Highness to begin.

Why such laborious reading? Sire, those who don’t learn from history are doomed to repeat it. Those who can’t read the writing on the walls are likely to wake up from their feathered pillows and find that neighboring brokerages have raided their precious little kingdoms. They will find themselves oblivious to the fact that their former citizens voluntarily renounced the crown and ever so enthusiastically swore allegiance to their new brokerage.

Surely I must jest? Certainly not! The people are tired. The people are hungry. The people are overworked and underappreciated. The people are frustrated with being asked to wait weeks to receive their commissions from the Royal Treasury. The people moan at their deprived conditions while you bask in your splendor. The people are growing deaf from all the lip service uttered from the Throne. Bothered by all the pretty windowdressing that brought them here but window shopping is as close as they are allowed to come. Outsiders looking in…

They demand action! They long to see a plan. They want to witness improvements made to the Kingdom. Fortifications made to protect them from outside forces hell-bent on plundering their farms and territories. Training to help them embrace changing times and rapidly evolving technologies. But, most of all they want to know that you actually care about their wellbeing more than prancing in your fancy robes at Court like a peacock strutting around the barnyard.

Who can you learn from in order to right the Read more

This is my column for this week from the Arizona Republic (permanent link).

As a matter of eating crow, I will attest that I publicly denied that housing prices could ever behave like securities prices, falling far below their fundamental value. The market has proved me wrong. We’re writing contracts on REO properties where the purchase price is well below the replacement cost. I read a listing for a potential rental property in a not-awful neighborhood that is selling for $49,500. We anticipate prices like that in premium rental neighborhoods when the Ameridream/Nehemiah calliope grinds to a halt. A house in Detroit was listed last week for one dollar. This bust behavior is just as irrational as the boon behavior — and it is a choice opportunity for people who are not irrational. Nevertheless, I was wrong. The real estate industry told buyers that homes were an investment just like securities — and damned if they didn’t believe us.

What went wrong in the real estate market? We told homeowners to treat their homes like securities investments — and they did…

If you were to turn back the clock on the Phoenix real estate market by four years — that would be just about right.

Judging by prices for bread-and-butter homes, it’s just as if the last four years didn’t happen. The average stucco and tile suburban dream home sold in July of 2008 for almost the same price you would have paid for it in July of 2004.

A lot has happened since then, of course. The 1,400 square foot single family home you could have had back then for $150,000 soared to $250,000 by December of 2005. That seemed like $100,000 in free money, and, regrettably, many people borrowed against that paper equity in their homes. Even if they did not, it has proved difficult to eradicate that entirely imaginary $100,000 from list prices.

The real estate market got hammered good and hard by two very bad ideas. The first is that homeownership is an unlimited good, that everyone should own a home regardless of their circumstances. Governments — and the National Association of Realtors Read more

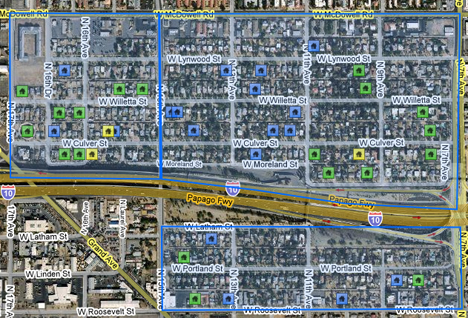

This

is the F.Q. Story Historic District in Downtown Phoenix as rendered by the flexMLS MLS system recently adopted by the Arizona Regional Multiple Listings Service. ARMLS is 30,000 Realtors working in the fifth largest city in the U.S. — and the 14th largest market area — so this is a big MLS system by any measure.

This particular map looks a whole lot better on the screen. I had to scale drastically to get it to fit here. Here’s the good news: You can see it for real, live, on a “portal” that I built for this post.

Do this:

Go here.

Your user name is: Jack Swilling

Your password is: demo

Please don’t reset the password, or no one else will be able to get in. For all of me, I would make passwords optional, but that’s only because I hate them with the passionate heat of a thousand suns — no big deal.

I built this search to show off just a little bit of what flexMLS can do. I’m not even a good tour guide on the subject. Cathy has a much richer base of experience than mine. For all the gee whiz technology we talk about around here, I am not an early adopter. The words you are most likely to hear from my mouth, when discussing new technology, are “mission critical,” and I won’t risk a mission critical function on something new until it is completely tested. I’ve been in love with the iPhone for 19 months — and I’m getting mine next week.

But, even so, this software is cool.

In the photo (or in the map view in the portal), you will see that I have defined F.Q. Story as three irregular polygons. Why? Because Realtors can’t spell. In principle, I should be able to use the “Subdivision” field in the MLS listing — but I don’t trust it. If the address is mapped correctly — and flexMLS makes it difficult to map a home improperly — it will show up in a polygon search.

And because I can use multiple non-contiguous irregular polygons to define a search, I can base my search of Read more