No. In a few months, when the wildflowers bloom, it will be even more breathtaking…

Live where it snows? Had enough? Isn’t it time to get your Winter back?

Sun City real estate - sell, buy, invest, relocate

Sun City Real Estate Broker

Hard to believe, isn’t it? You can actually sell a home in Greater Phoenix and make money on the deal.

How can this be so? The long answer is long and boring, but the short answer yields a comprehensive truth in only two words: Market volatility.

We were a slow leak on the way down, until all of a sudden we were a fast leak. And then, just as suddenly, the market surged upward, gaining back a lot of lost price-pressure very quickly.

The result? If you bought a house in Phoenix or its suburbs within the past two or three years, it could be possible for you to sell that home and actually pocket some cash on the deal.

How much money could you scrape off the table?

It could be a lot, actually. We’re getting ready to list a property where we expect the sellers to more than double their 20% down-payment in less than 15 months, total, since they closed on the home.

It could be a lot, actually. We’re getting ready to list a property where we expect the sellers to more than double their 20% down-payment in less than 15 months, total, since they closed on the home.

Your mileage will vary, of course, but you only need to beat your original purchase price by 7% or so to put yourself in the black — and home values are up more than 30% over the past year.

Okay, so you might be able to sell at a profit. Why would you do it? And why now?

The why is your question to answer: To move up to a better home, to move down to a house you can own free-and-clear, to move on to another part of the country, to get your money out of housing and put it into a business — your reasons are your own.

But why now? Because supplies of homes are very low, demand is insanely high — and because neither of these circumstances can last forever.

It could be that we’re back on the appreciation track for the foreseeable future, in which case holding out for higher prices makes sense.

But it also could be that the recent upsurge in prices is the eye of the hurricane, and continued foreclosures combined with other bad economic news could push home values down yet again.

I don’t know which will happen — but I know that no one else knows either.

But if you have a reason to sell your Phoenix-area home, we can make it sell quickly and for top dollar right now. If you want to explore your possibilities — and calculate your potential profits — drop me a line.

With the recent surge in home prices, for the first time in years it matters how you market your home for sale in Greater Phoenix.

With the recent surge in home prices, for the first time in years it matters how you market your home for sale in Greater Phoenix.

Lender-owned homes are sold like a grab-bag of garbage, take it or leave it. And while short-sellers might want to do a better job of marketing, typically they just don’t have the cash needed to do the job properly.

But now many homeowners in Phoenix, Scottsdale, Paradise Valley and the suburbs of Metropolitan Phoenix have equity in their homes. They have a chance to make some money when they put their homes up for sale.

And that little fact makes all the difference…

Why would you want to mount a serious marketing effort to sell your home? To sell it faster, for more money, with less hassle and to a better-qualified buyer.

Marketing always matters, but when the seller has equity on the closing table, a good marketing effort can pay off at $10 to $1 — or better.

We wrote the book on selling homes in Phoenix, a comprehensive, deeply detailed guide on what works and what doesn’t. If you’re thinking about selling, let’s talk about why marketing your home for sale can make all the difference.

This is what’s really happening: FannieMae and FreddieMac are holding foreclosed houses off the market, in anticipation of “selling” them to campaign donors.

Meanwhile, the town is being picked clean, with prices being bid up by buyers convinced that houses are going out of style — a story we’ve heard before, yes?

As an example, my BargainBot search, which is shared with hundreds of investors all over the world, is at less than 5% of it’s peak. A search I use to select premium rental homes produces one listing this morning, where it stood at 45 homes in April of 2011.

If Fannie and Freddie “sell” the homes they own to politically-connected “investors,” the rental market in Phoenix will be slaughtered.

And if they release the homes they have been hoarding into the MLS, Phoenix will hit a third bottom before the market can finally recover.

You can call the news media idiots or you can call them liars. But any news from any official source about Phoenix real estate is dangerously misleading.

Meanwhile, if you need to sell, your house will go for top-dollar at blinding speed.

The photo is from a house Cathy closed on Wednesday, a get-away-from-it-all mini-mansion way out in the desert. That’s what they call a street, when you get that far out. You can measure how clean the air is by the definition of my shadow, maybe sixty feet away. On the way home, we saw a yearling coyote on Dear Valley Road.

Our annual late summer “monsoon” is being pushed out of the Valley of the Sun by very hot, dry weather rolling in from the Mohave Desert. Within the next couple of weeks, we will shift back to the dry heat that makes Phoenix so perfect all winter long.

Everything we do as Realtors is informed by two simple ideas:

That’s a pretty simple ethic, a hard target to miss. And it is the philosophy we will deploy as we enter the property management business.

Despite many requests from our investors over the years, we’ve avoided doing this, primarily because we have never liked the way that other companies handle property management. Real estate is an active pursuit, best undertaken out in the world, where property managers have always seemed to me to be much too interested in working office hours and taking weekends and holidays off.

But that creates a market niche, doesn’t it?

We bring years of careful thinking to our representation of suburban Phoenix rental home investors. We go to great pains to find the right houses in the right neighborhoods, homes that will rent easily and stay rented to premium tenants, and then we prepare those homes to make sure they will be appealing to those tenants. I don’t blow smoke up anyone’s nose, and I don’t let the investors I work with make profit-killing mistakes. We have gotten so good at this, over the years, that the homes we are involved in routinely command the highest tier of rents, among comparable properties, attracting their first tenants in less than twenty days on market.

And we want to bring that same level of commitment to the property management business. We know what we don’t like, in the way this business has been done until now in metropolitan Phoenix, and we know what we would want done, if we were the landlords or the tenants. So now we’re going to put our philosophy to the test, to see if we can’t reinvent property management, just as we have reinvented investor representation.

We’re starting with one house, a four-bedroom ranch home in Avondale’s Coldwater Springs. We represented the buyer in the purchase of the home, and we got it at a deeply discounted price, because no one else wanted it.

Handyman of Phoenix Mark Deermer whipped the home into shape, and we were able to put in on the MLS system just a week after we had closed escrow.

Do you want to take a moment to sharpen your pencil? The home was leased for two years at full price in twelve days on market. We got $1,050 per month in rent, even though there are two competing homes in Coldwater Springs in that exact same floorplan languishing on the market at $995 and $895 a month. We had our choice of applicants, and the house was showing so much I took the lockbox off once we signed the lease.

Your mileage may vary, of course. Every house is unique, and no one hits a home-run every time at bat. But we’ve always been able to select and prepare houses that rent well and stay rented, and we are confident that we can apply the same kind of intelligence and diligence to the job of keeping our tenants happy and our landlords profitable.

Even so, this is a work-in-progress, and we’re boot-strapping the business, rather than trying to take on hundreds of properties all at once. But the systems we’re putting in place will be unprecedented in the Phoenix real estate market. As an example, every landlord and every tenant will have a page on our computer system. Tenants can log-on to post maintenance requests — or to pay their rent electronically. Landlords can check into the system to see an up-to-the-minute accounting of their funds. Every dollar of inflow and outflow will be accounted for on-line, with instantaneous posting. No more waiting to find out where your money is. No more float games with your proceeds.

There’s more — and more to come. You can see our Property Management Agreement by clicking this link. We’ll be working with the court-tested Arizona Association of Realtors Rental Lease, modifying its terms with our custom Lease Addendum, which you can review by clicking this link. The bottom line is, we’re going to do property management the way it’s never been done in greater Phoenix — happy landlords, happy tenants, happy neighbors.

I would love to talk to you more about this. We can discuss taking on the management of your existing rental properties, when their current management contracts come up for renewal. Better yet, we can go out shopping for suburban Phoenix rental homes and put them under Bloodhound Realty’s management from the first tenant. If you want to explore your opportunities, contact me by email or give me a call at 602-740-7531.

…with Phoenix being the most beautiful and the most affordable, of course.

If you’re snowed in, stuck at home with nothing to do but surf the internet, the movie linked below will show you a better way of living…

That’s a nice looking home, isn’t it? It’s in Coldwater Springs in Avondale, Arizona, one of my favorite subdivisions in one of my favorite suburbs of Phoenix. I have sold many homes in Coldwater Springs, both to owner-occupants and to rental home investors, always with happy results.

So what’s wrong with this wannabe rental home? A lot, as it turns out.

For one thing, the home is facing straight west. The entire front of the house is going to get blasted by the brutal desert sun all summer long. That means much higher air conditioning bills. Tenants can glower at their bills just as well as homeowners. The result is that west-facing homes in Coldwater Springs sit vacant an average of 21 days longer than comparable north- or south-facing homes. That’s three extra weeks on market — if you’re lucky — every time the house goes vacant. Money talks: Call it a $750 loss in real cash money every time the home has to find a new tenant.

That’s a bad mistake on the investor’s part, but here’s a worse one:

Yes, that’s a major thoroughfare right behind the home. The house will always suffer from traffic noise — but never quite so much as when potential tenants are rejecting the home and moving on to the next candidate on their shopping list.

It gets worse. The house is oriented toward the corner in such a way that anyone heading south at night will flash their headlights right in the living room window. Dozens of times a night, every night. Tenants may learn to ignore the traffic noise, but they’re never going to learn to love having headlights in their home all the time.

There’s more. Check this out:

At $1,095 a month, this rental home is overpriced, but not by a huge amount. Facing north, without the headlights and traffic noise, it would be worth around $1,050 a month. Discounting for the truly awful location, it’s going to rent for less — maybe $975 if the landlord gets very lucky.

So what’s the benefit of pricing this house at least $120 a month over the rent it can reasonably be expected to earn? No pesky phone calls — to the landlord’s phone in Riverside County, California. The “marketing strategy” of posting two hardware-store signs in the window is just the icing on the cake.

Just think! Tenants can over-pay on the rent in order to have a home in a poor location. They can suffer traffic noise and headlights in the living room all night. They can pay at least $1,000 more a year in air conditioning costs. And they can deal with a remote-control landlord who, to all appearances, is committed to demonstrating in his every decision that he can’t get anything right. Why would they ever even consider renting another home instead?

In real life, the only tenants who will apply to lease this home will be the folks who have been turned down by every other landlord they have approached. All of the premium tenants — good jobs, good credit, good rental history — will be living in premium homes, while the tenants who land in this home could easily be slow-pay — or no-pay — candidates for forcible eviction. And remember, this home will cost an extra $750 in vacant days, on average, every time it goes vacant.

All of the identifying details about this property have been obscured to avoid humiliating the guilty party. But this exercise is a slam-dunk demonstration of the reasons why rental home investors need representation — expert representation.

I’m a salesman, that’s a fact. I make my money selling houses. But I don’t ever sell the wrong house, and I don’t ever let my investors make even minor errors, much less boneheaded mistakes like these. I have lots of ideas about how to make money investing in rental homes in the suburbs of Phoenix. If you would like to explore every idea I have for getting things right — buying the right house in the right location and then marketing that home to premium tenants, all at very substantial annual cash-on-cash returns — drop me an email or give me a call at 602-740-7531.

Christmas is family and friends and lots and lots of food. It’s gifts and the spirit of giving and glad tidings of great joy. But Christmas is also the time of year when we think about the year just ending and the new year about to unfold. We are very lucky to be able to work with people we respect and admire, to be a part of life-changing events in the lives of those people. Never doubt our gratitude. We couldn’t run our business without you, of course. But our lives would be less joyous without the real estate roller-coaster we get to ride with you. Here’s wishing you every good thing a well-lived life can provide!

Your mortgage lender just called. The appraiser is standing outside the home you’re hoping to buy, but there is no key in the lockbox. The lender called you so that you could call your Realtor. Your Realtor in turn can call the listing agent, and then someone can get over to the house — pronto! — to let the appraiser in.

There’s just one problem: You can’t seem to get your Realtor on the phone.

Stuff happens. Your Realtor could be tied up with another client or stuck in traffic in a cell-phone dead zone. Heaven forbid, he might have been in a car accident.

But… There is another possibility…

Do you remember when you first made contact with your Realtor? Do you recall him telling you all about how hi-tech his business is, detailing his presence on all the biggest social media sites?

So: If you’re not getting your calls to your Realtor returned, where might be a good place to look for him?

How about Twitter, for a start? How about Facebook? Foursquare? Tumblr? Posterous? You might have to look in a few places, but there are only two kinds of hi-tech Realtors: The kind who work a lot and the kind who play a lot.

How can you tell if your Realtor is the kind who plays a lot? It’s easy. He’ll be leaving tracks all over the place, Retweeting jokes and commenting on Facebook photos and writing detailed reviews of burger joints and doing — and documenting — just about any activity on the face of the earth — except attending to your real estate transaction.

Here’s the sad part: Even if you’re seeing dozens of Tweets and Facebook comments from your Realtor, you’re probably just seeing the tip of the iceberg. You’re not seeing the direct Twitter posts or the private conversations being carried out on Facebook or in email.

But: If your Realtor seems to be wasting his entire day on social media sites, there’s a reason for that:

It’s because he’s wasting his entire day on social media sites.

I’ve tried pointing out to Realtors that schmoozing on Twitter or Facebook is bad marketing, so far to no avail:

I say that trying to sell real estate via Twitter/Facebook is a waste of time — and it is anti-marketing even if it seems to produce some results. Why? Because the bulk of your chatter is going to look like… chatter. Your clients might like it when you schmooze with them, but your public schmoozing with every other time-wasting Realtor and vendor in the RE.net is going to look to your clients like just what it is: Time-wasting laziness.

Here’s the good news: You have the power to do something about this. Once you’ve discovered that your Realtor is ignoring your needs in order to goof-off online, put him on notice: “You will either service my transaction or I will fire you with dispatch.” You’re the boss. Act like it.

Even better, when you’re shopping for a Realtor, shop his or her online presence. Is your prospective Realtor a big-time Twitter kibitzer? This will come back to bite you in the butt. Is she an all-day Facebook schmoozer? Be prepared to handle your own transaction; your Realtor has another job she likes better than the one you’re offering her.

Why can’t you get your Realtor on the phone? Why don’t your repair issues get dealt with? Why is your lender calling the title company for you? Why is there an appraiser stranded outside your new home?

Part your problem is that you have a lazy Realtor.

The other part is that you have been a lax supervisor.

Whether your are a home seller or a buyer, you’re paying a lot of money for real estate representation. If you’re not getting it, you must either demand better performance immediately or take your business elsewhere.

The beautiful thing about capitalism is that you can always put the bums out of work. That’ll give them something to chat about online…

I pick properties that rent quickly and stay rented to premium tenants. I know what works for rental properties, I know what they will rent for and how much to pay in acquisition costs. Handyman Mark Deermer whips them into shape in scratch time, so we can minimize vacant days. Our track record is excellent.

Phoenix is crawling with investors who are making spectacular mistakes — buying bad houses in the wrong neighborhoods and dealing with the headaches of too much competition and inadequate rents.

These are better choices for Phoenix-area rental home investors, by far. I know exactly what I want, and I’m always shopping for new opportunities. If you would like to be a subscriber to my shopping list, say so.

The Arizona Republic has taken to calling a bottom to the Phoenix real estate market about three times a month.

Like this: A certain subset of high-end homes are selling for more than expected, so the sour market must be over. New home builders are making brass-band noises by press release, so the drought must be ending. The number of homes listed as Sale Pending is rising, so happy days must be here again.

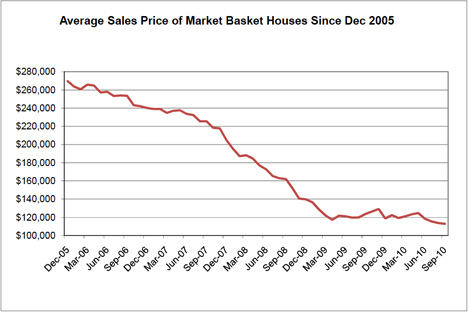

All of this is false, alas. We track the broader market, month-by-month, and allowing for silly tax-credit tricks, the long-term trend of the Phoenix real estate market has been downward since December of 2005.

Here’s the big picture, minus the hype:

Those are bread-and-butter suburban tract homes, so your mileage may vary — slightly. But with the exception of niche products — high-demand Scottsdale condominiums and some age-restricted housing — that’s a pretty clear picture of the real estate market as a whole in the Valley of the Sun.

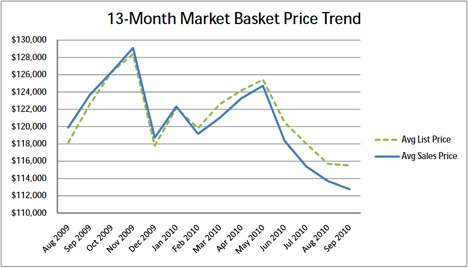

Here are the past 13 months under a microscope:

I’ve been saying for years that no one should overpay in this market, but you can see for yourself that tax credits make people do foolish things. But what’s most interesting to me is that the gap between listed price and sold price is growing.

In other words, this market likes hard bargainers.

The bottom line? It’s a great time to be a buyer or an investor, it’s a lousy time to be a seller, and we are a long, long way from living in a healthy real estate market.

You can track our numbers as we record them here: The BloodhoundRealty.com Market Basket of Homes.

Better yet, you can see what you can get for your money — or for your house — by giving us a call or making a showing or listing appointment. Drop me an email or phone me at 602-740-7531 and let’s figure out how to take best advantage of this real estate market — as it really is.

Phoenix handyman Mark Deermer and I took a look at five relatively inexpensive homes in Surprise, a northwest suburb of Phoenix, that could work well as rentals properties.

Our findings — with photos, links to MLS listings and projected financials — are linked here: Rental home investment possibilities in Surprise, Arizona.

Here is one of the properties we saw, as an example of the kinds of things we’re taking into account:

17410 West Lisbon Lane, Surprise, AZ 85388

List price: $79,900. 3 bedrooms, 2.5 baths. 1,578 square feet. Courtesy of: RE/MAX Professionals. Google map. Schools: Elementary, Junior High, High School. Property tax record. MLS listing. Nearby homes for sale.

Estimated repair costs: $7515.

Estimated rent: $850.

Initial offer: $75,000.

I don’t hate offering less than that, but getting an offer accepted on a lender-owned home is always a game of double-think. The longer a property has languished — which usually means the worse its condition — the more flexible the bank will be on price.

Handyman Mark Deermer is touring these houses with me. His repair estimates take into account everything we see — stipulating that unseen problems may turn up when we do the home and wood inspections. But his estimate is the cost to turn any candidate home into a turn-key rental — a home you will be proud to own and your tenants will be proud to maintain.

When I project rents, I’m working from recent closed leases in the MLS for that size and style of home in that subdivision. I deliberately understate the numbers, because I want any variation to come as a happy surprise.

Also, I am hand-selecting the properties we look at. I eliminate a lot of towns and subdivisions because the tenant pool is not as deep as I want. I rarely even consider a home with a poor western exposure, since this will increase the air conditioning costs for the tenant — which will induce the tenant to rent someone else’s house instead. I tend to favor easy access to schools and shopping. And even when we visit a house that meets all these criteria, I may eliminate it if I don’t like the floorplan — or just the feel of the home.

This is the lay of the land: Phoenix has always been a soft rental market, but the homes I pick tend to rent quickly to premium tenants, they tend to stay rented, they tend to suffer little vacancy between tenants, and they should sell quickly and at a premium price to owner-occupants on the way out.

We’re doing everything we can to maximize the profit potential of the homes we sell. If you click through to this weblog post and follow its links, you can find out a lot more about Bloodhound Realty’s rental property investment philosophy. But the bottom line is the bottom line: You’re investing in rental homes to make money. We’re cherry-picking (and cherry-polishing!) just the right houses to make sure you do.

There are 30,000 Realtors in Metropolitan Phoenix. Why should you work with us when you’re ready to invest your heard-earned dollars? Because we’ve thought this problem through, and we’ve arrived at what we think is an optimal solution to maximize your profits and minimize your headaches. Prices are low, interest rates are low, and, if you get just the right house and serve it up just right to the marketplace, there is money to be made in suburban Phoenix. Drop me an email or phone me at 602-740-7531 and let’s talk about making some of that money for you and your family.

Phoenix handyman Mark Deermer and I have been prowling potential rental homes in the western suburbs of Phoenix. I’m looking for all of my usual stuff — all the factors that make the Metropolitan Phoenix rental homes we sell rent quickly and stay rented. And Mark is going through the homes to get a quick estimate of the cost to refurbish the homes, bringing them into rent-ready condition.

This is an easy world to live in right now — for buyers, at least. The quantity of available homes is rising, and the quality of those homes seems to be going up, too.

Here are six properties we’ve seen lately.

This all about strategy: We start with homes that might work and that are not insanely overpriced. Working from a projected rent, we know what the maximum entry cost should be. Mark’s refurb cost is subtracted from that gross number, which yields the ideal purchase price. We make the offer on that basis. If we get the house, we get it. If not, we move on. But if we do get the property under contract, we know that it will be profitable from the first tenant.

Ready to make your move? Send me an email or phone me at 602-740-7531 and I’ll help you buy a Phoenix-area rental home like one of these.

My friend and colleague Al Lorenz, who sells real estate and develops real property in Lake Chelan Washington wrote and posted this Real Estate Declaration of Independence.

Al and I are in complete agreement about these principles, so I’m delighted to share them with you:

Real Estate Declaration of Independence

We, the people who buy and sell real estate, hold these truths to be obvious:

- We the people believe that information on real estate for sale should be readily accessible without surrendering our private information. We reject having to register on a web site in order to view listings in an area. We value our time and will contact a real estate professional when we are good and ready for their services.

- We the people reject all policies of the National Association of Realtors that are not in the best interest of the real estate buying and selling public. Limiting our access to information, restricting our ability to a free and open market through regulation and limiting our market choices are all examples of policies we reject that are designed to line Realtors pockets at the expense of the public.

- We the people reject “Dual Agency,” where a real estate agent has an inherent conflict of interest with his agency and fiduciary duties by attempting to represent both the buyer and seller in order to earn a larger commission on our transaction. If the agent is truly delivering value, both parties of a transaction have an equal right to that value without a conflict of interest and each party deserves their own agent in the transaction.

- We the people reject the practice of real estate agents trying to “Buy the Listing” by telling a potential seller an above market price in an attempt to secure a listing. This practice costs sellers time and money while their home sits on the market as the agent waits for the seller to cut the price to where it should have been to start.

- We the people reject the practice of real estate MLS systems that limit a home seller’s exposure to potential buyers in an attempt to control access to a market. A listing agent’s responsibility is to market a property to the best of their ability and limiting the exposure of our home costs us money.

We the people are independent in a country that still allows us to make market choices. We the people demand better service and will exercise our freedom of choice and only choose Real Estate Professionals who deliver better value.

In Arizona, a real estate licensee has a fiduciary duty to his client. That means that, when we decide to work together, I am obliged to put your interests ahead of all others, including my own. Too often, and much too deservedly, Realtors are perceived as being self-dealing, self-serving and self-absorbed. If you keep this Real Estate Declaration of Independence in mind, you’ll be better prepared to avoid that kind of agent.