This is me in today’s Arizona Republic (permanent link):

‘Fizzbos’ fizzle because of 3 key marketing issues

I have a friend in another state who is selling his home “by owner,” which Realtors affectionately refer to as a “fizzbo.” It’s interesting for me to watch, because he’s done a very professional job.

We should note at the outset that most “for sale by owner” (hence, fizzbo) efforts fail. Of the three P’s of real estate marketing — price, preparation and presentation — many fizzbos will fail on two or even all three.

First, if a home isn’t priced to the market, the home will not sell. This is why so much inventory, even Realtor-represented inventory, has lingered on the market so long over the past 15 months.

Second, the home has to be in turnkey condition: in excellent repair and staged to perfection. If it isn’t, it should be priced accordingly. Even then, most buyers in this market won’t give it a second glance.

And finally, the home must be appropriately marketed.

A fizzbo is at a huge disadvantage over a represented sale. At an absolute minimum, a Realtor-represented home is advertised through the MLS system to every other Realtor in the market.

By contrast, the by-owner home is promoted only to people who happen to drive by and see the sign or who happen upon a newspaper or online ad.

An aggressive Realtor will do even more to market your home, targeting promotions to the people most likely to buy.

And that’s what’s interesting about my friend’s efforts. He is a marketing professional, so he had presentation more than covered. He has excellent taste, and he keeps his home in pristine condition, so his preparation was perfect. And he consulted with Realtors and, ultimately, an appraiser to make sure his home was priced right.

You could call this a semi-professional for-sale-by-owner sale, and my advice would still be: “Don’t try this at home.”

But note this: He “launched” his home to the marketplace on Dec. 23, which no professional would have done. The result? Showings all through Christmas weekend, when people had time available to look at houses.

Technorati Tags: arizona, Read more

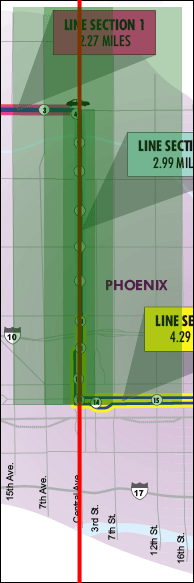

The most important thing to understand about the forthcoming Trolley in Phoenix is that it’s built on the wrong route. This was deliberate. The greatest concentrations of bus passengers in Phoenix are in Sunnyslope and in South Phoenix, at either end of Central Avenue.

The most important thing to understand about the forthcoming Trolley in Phoenix is that it’s built on the wrong route. This was deliberate. The greatest concentrations of bus passengers in Phoenix are in Sunnyslope and in South Phoenix, at either end of Central Avenue. Enter the folks from

Enter the folks from