My entry: “A gentleman always makes eye-contact.”

There’s always something to howl about.

My entry: “A gentleman always makes eye-contact.”

This is my column for this week from the Arizona Republic (permanent link).

Notes for insiders: The legislative thumbprint of the National Association of Realtors is churn. The NAR is not necessarily for or against any legislation. Instead, their lobbyists will look for ways to introduce short-term incentives to churn real estate — artificial inducements to buy or sell real estate now rather than on the consumer’s own timetable. In this bill, getting rid of seller down-payment assistance, introducing the new-buyer tax-credit and revising the capital gains exclusion rules all promote short-term churn. What about the long-term? The NAR knows it will be able to lobby for new real estate-churning legislation next year — at every level of government. This is just another example of the fundamentally anti-consumer character of the NAR.

Here’s another thought: Wouldn’t it be great if, instead of regurgitating Zillow’s gee whiz press releases, the real estate reporters of the mainstream media actually reported on what is really going on in real estate?

There’s more to the mortgage relief bill than just mortgage relief

Having trouble making your mortgage payments? You might be able to make a change in your loan, thanks to the mortgage relief bill President Bush recently signed into law. Under the bill, you can convert your high-interest adjustable-rate loan to a lower-interest fixed-rate note if you meet what might, in a declining market, seem to be Catch-22-like guidelines: Your payment must be more than 31% of your income, and your new loan cannot exceed 90% of your home’s value. Help is available — provided you don’t need it.

Starting October 1st, seller-paid down-payment assistance grants will be outlawed for FHA loans. This is bad news for lower-priced neighborhoods in Metropolitan Phoenix, where as many as nine out of ten homes are being sold with down-payment assistance. Expect to see a flurry of this activity in the next two months.

But the left hand gives where the right hand takes away: Buyers who have not owned a home for three years can take a $7,500 “refundable” tax-credit if they buy between April 9, 2008 and July 1, 2009. The credit Read more

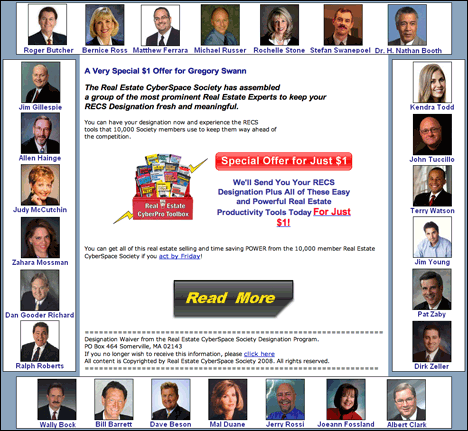

This came in my spam this morning, and I gave it nine seconds of my full attention: Babbling jargon-filled nonsense, probably with a well-hidden chokepoint to spill coins into the author’s pockets.

That was my instant take, but the truth is I don’t actually know what it says. To the extent that I actually tried to read it, it was too painful for me to pursue.

It could be you have more patience than me. If so, you might take a stab at figuring out what it says. It doesn’t actually matter, since the meatballs atop this sticky bowl of word spaghetti are the same ones who brought us Realtor.com and all the other big-hit NAR disasters. If anyone actually believes these wheezing antiques can outrun the VC-funded Web 2.0 world, I have a few dollars I might be willing to wager. The NAR will solve every problem it confronts by force of arms, as always.

But: That doesn’t mean you can’t have some Friday Afternoon Fun trying to parse the mangled prose that makes up this proposal. Plus which, I’m inclined to be very generous if you should unearth the chokepoint.

Note that this deeply heartfelt manifesto appears on a page full of advertising. Classy… Inman “News” dipped its pen in this spittoon, of course, but that’s such an obvious outcome it’s not even worth making jokes about… Oh, fine. Here’s one, just because it’s Friday:

Q: What do you need to get fawning, uncritical attention for your press release from Inman News?

A: A press release.

Read carefully and I expect you will discover how the NAR hopes to rape agents and consumers over the next decade. But remember this as you read: Divorce the commissions and every bit of this nonsense goes away, as it should.

Technorati Tags: disintermediation, real estate, real estate marketing, technology

So, it’s Friday again and what has this week been like for the mortgage world? Well, it’s certainly not been boring, that’s for sure! We’re going to talk about six different things in today’s Mortgage Market Week in Review:

Freddie Mac – They started the week’s major news by announcing on Tuesday that they had lost a LOT more money than the market had expected in the last quarter, like $821,000,000 in 90 days. That works out to approximately $380,000 per hour in losses. The markets started worrying about the likely that the government will actually have to bailout Fannie and Freddie. The credit markets get nervous (or more nervous depending on your viewpoint).

The Fed – on Tuesday it would appear at first glance that what they did was a big fat nothing. I’ve done a fair amount of reading and studying of Bernanke and his views and I think I’d have another take on it. What the Fed said on Tuesday was (my paraphrase ![]() “The economy has some risks on both sides, the risk of recession and the risk of inflation, we’ve made the moves we’ve needed to make, we will continue to monitor things to make sure that the outcome we’re planning on happens, we think it might be a bumpy landing, but we’re confident we’ll be fine.” So rather than a “do nothing” statement, it was more of a “Things will come out okay, just be patient” statement. Does that make sense?

“The economy has some risks on both sides, the risk of recession and the risk of inflation, we’ve made the moves we’ve needed to make, we will continue to monitor things to make sure that the outcome we’re planning on happens, we think it might be a bumpy landing, but we’re confident we’ll be fine.” So rather than a “do nothing” statement, it was more of a “Things will come out okay, just be patient” statement. Does that make sense?

AIG – Not to be outdone by Freddie, AIG announced that during the second quarter, they lost $5.36 billion (that’s $5,360,000,000 or $2,481,000 per hour). Their losses were in collateralized debt obligations (aka CDO’s) that were mainly fancy packages of mortgage debt. Hmmm, that’s a pretty big number.

Unemployment Claims – Initial claims for the week came it at 455,000, the highest since 2002. That’s not a good number.

Pending House Sales – depending on whether you listen to the mainstream media or some of the analysts who look at the numbers behind the numbers, the report is either: 1) A sign that the housing market Read more

Henry Blodget reports that Chokepoint Charlie is upset:

We view the Olympics as a global sporting tradition and consider ourselves citizens of the world, so we don’t have much patience with country-specific broadcasting rights. Thus, we’re happy that we (and you) can watch the Olympics live right here on on SAI.

(Frankly, we wish we could watch the Olympics on NBCOlympics.com, because their feed is marvelously crisp, but of course NBC is doing everything it can to prevent that. Specifically, NBC is trying to make us watch tonight, on tape delay, when the opening cermonies will be as stale as yesterday’s bread. And when they do broadcast events on NBCOlympics.com, of course, they’re not about to let us embed them.)

NBC views the 2000+ year-old global Olympic tradition as its own personal entertainment show and is therefore doing everything it can to prevent you (and us) from watching them live. For example, check out these takedown notices on veetle.com:

You don’t have to take it. Watch the Olympics LIVE, from your computer, here .

I’m with John Rowles — and then some — on the true, mostly unrealized, power of branding in real estate. I’ve been meaning to write about it, but I’m sick for the second time this summer, and it’s left me beyond stupid at the end of the business day.

Other matters: We are that close to negotiating a space for Unchained Orlando, this despite the best efforts of the NAR to dominate every meeting space. I may have an announcement tomorrow.

But for tonight, Al Jarreau and three fingers of Irish cough syrup. G’night.

Technorati Tags: BloodhoundBlog Unchained, real estate, real estate marketing

I wrote this article on Active Rain, about two months ago. It’s got legs in the comments’ thread over there. You’ll see that the REAL reason I’m worked up is that the “new sleazy option ARM advertisement” is to claim that you KNEW it was bad for the customer. The opposite is actually true

I’m pretty high-touch with my neg-am borrowers. I keep in close contact with them quarterly. I just received notice that one of them had a notice of default filed against them for non-payment. The borrower lost his job and elected to use the “side account” he established, from the monthly cash-flow savings, to rent a new home rather than to “feed the depreciating asset” (his words).

Before you comment on the article, you might read all of Dan Green’s “Mortgage Planning” articles. if you haven’t the time to read all of them, read:

If Low Downpayments Are More Risky To Banks, They Must Be More Safe For Home Buyers

I’d argue the same logic applies for negative-amortization (rising mortgage balances).

Here’s the article:

Remember the “sleazy Option ARM advertisements“?

They’re back but with a whole new twist:

This is why I never did option arms. This is part of the reason why we are in the housing mess we are in. Yes, borrowers have to claim responsibility, but every Bank that pushed neg am as a financing alternative deserves the billions in write downs and losses in stock options that they are mired in. I have no sympathy for them…only contempt!

Oh, brother! If I see one more loan hack Monday morning quarterbacking this mess I’m gonna puke. There is nothing wrong with negative amortization loans; there was something drastically wrong with the way they were prescribed. The “new neg-am” advertisements are “posited indignation” and they’re just as sleazy as the original advertisements. They prey upon the opposite of the greed motivation; fear. That ain’t helping anybody!

Let me try to break down the negative amortization loan for you:

Honestly, I think Aretha got it right – stick to seven letters, melodically I think it just works better.

Anyway – in my family I’ve been labeled “you liberal” – the second youngest of eight kids. Accountability, Responsibility, Discipline and Consequences were not just words, but codes of conduct – drilled into my skull – in The Hall Household, not at all surprising considering my dad is a ’53 West Point grad. Punishment was a given – or should I say consequences were always delivered. Spankings were called “reminder taps” – mind the pun – for at times, taps held near dual meaning if you catch my drift.

I typically save controversial or political discussions for funerals, weddings or family renuions because, being usually void of any emotional energy, I find that people are compelled to share their views in rational discourse – no such events planned in my near future so I am forced to share my views in the emptiness of cyberspace.

Is it me or have others noticed – in reading the headlines, blogs and other online sources, I am struck by the lack of consequences and accountability due to poor judgment – a lack of management shakedowns at some of the largest companies that I suggest are at the crux of the housing debacle.

Starting at the top at Bear Sterns, haven’t heard but a blip regarding heads rolling. No news of foreclosures on Upper East Side Townhomes or penthouses – no sheriff warrants issued in The Hamptons – no learjet repos. Government bailout – yep. Significant management changes due to the consequences of poor judgment? Nope – just talk of a takeover.

Seems that same is true over at Countrywide – more “seasoned” managers have been moved around and the CEO simply retired – B of A put their guy in charge of mortgages. Plenty of seasoning but little grilling. Wamu’s shareholders sought accountability and won a majority of votes to remove the chairman and CEO positions – but not a great deal more – in fact senior executives’ bonuses were shielded from the loses attributed to the mortgage-related business. I Read more

The Federal Reserve released it’s August statement yesterday and pundits are scrambling to interpret what was and (equally as important) wasn’t said. Financial market participants have a 10-15 year history of trying to “outguess” the FOMC and focus more on the commentary than the actual decisions. The result has been volatile market movements directly after a word was changed from “probable” to “eventual” in the Fed commentary.

I’ve learned to trust Fed Chairman, Ben Bernanke’s judgement. An astute student of Milton Friedman’s study of The Fed’s role in the Great Depression, Bernanke has taken considerable action to preserve a healthy banking system. Free market enthusiasts would argue that his intervention is artificially postponing the eventual asset deflation reflective of a dour economy. I’d argue that his actions were necessary to promote confidence.

Confidence.

Sean Purcell and I discussed the press’ obsession with doom and gloom yesterday. Last month a Qantas 747 lost a portion of its fuselage, had to quickly descend below the 10,000 “hard deck”, and make an emergency landing. The 2.0 world gives us citizen journalism in the form of this passenger video. Watch it and you’ll see a professional air crew inspiring confidence in faithful passengers.

The Australian News realized that “professional” and “rational” won’t sell fishwraps and elected to lead with “Terror As Huge Hole Cripples Qantas Plane“:

A QANTAS jet plunged 20,000 feet and was forced to make an emergency landing after a giant hole was ripped in the plane’s undercarriage, passengers say.

The Qantas Boeing 747, en route from London to Melbourne, via Hong Kong, landed safely today and a “gigantic” hole was discovered in the belly of the plane, near the wing.

Some of the 346 passengers on board told of debris flying through the depressurised cabin, and oxygen masks dropping from the ceiling. Some said the plane had plunged about 20,000 feet after a door “popped”.

“There was a terrific boom and bits of wood and debris just flew forward into first (class) and the oxygen masks dropped down,” Melbourne woman Dr June Kane told ABC Radio.

An option to “lead with the bleeder” rather than the heroism of the air crew. Read more

This

incites no end of questions for me.

For example, exactly how will my mastery of Real Estate Cyberspace have improved by sending these schmucks a dollar?

If I send two dollars, can I be twice as wizardly?

Precisely how much value should my clients put on a real estate designation that is just as difficult to obtain as an Official Inman News sippee cup — but $148 cheaper?

Yes, yes, I’m sure there’s fine print, but I’m a high D and I don’t care. Here’s the question that made me crazy for days:

I don’t know of all of those twenty-six people who lent their names and faces to this vastly stoopid promotion, but I know of quite a few of them. Presumably they took some pains to make themselves famous in the real estate vendor space. My question:

Why would they deliberately wreck their reputations by associating themselves with this sleazy wreck of a real estate designation?

I’m quite serious. I’ve had this email open all week, trying to figure it out. I get slimed all the time by creepoids trying to leech away the value of my recommendations, but the sole power I have in the marketplace of ideas is my reputation for integrity. Because I never attach my name to crap, you know that, if I do praise a product, I’m doing so for reasons I consider valid. I can’t imagine taking money to endorse a product, but, surely, it is far worse to take money to endorse a product that — by its own admission — is not even worth a dollar!

And it’s not one wannabe real estate bigfoot up there, it’s twenty-six of them! Reputation is all there is in the Web 2.0 world. Why would they squander the intellectual capital they worked so hard to accumulate?

I couldn’t work it out, but then I stumbled on an infomercial-like sales presentation that made the whole issue clear to me:

Mind what goes into your mind.

Technorati Tags: real estate, real estate marketing

Now where was I…? Oh yeah, poking fun at my fellow real estate consorts for exhibiting groveling-like behavior in a buyer’s market. But that was three weeks ago and as we all know, a lot can happen in 21 days. It was also the last time I personally wrote a deal or, for that matter, even had a legitimate buyer in my car.

In 21 days they say a person can break a habit, create a habit or change a behavior. In 21 days most solid citizens should be able to negotiate a real estate offer, secure a mortgage commitment, and receive a clear to close letter from their lenders (one would think). In 21 days a well priced property, even in a lukewarm urban market like Chicago, should have at least one decent showing (ditto the above sentiment). In 21 days, the average household fly has experienced its entire lifespan without even having a genetic shot at morphing into a butterfly– unlike his other, more birth privileged fellow insect, the caterpillar. And in the blink of an eye (plus 21 days, give or take) and a thimble full of fate, it can all change…

My parents were married 10 years before I came along–that’s how they always put it; “…then you came along,” which I was cool with, mind you. No therapy issues here. As a youngster I had this imaginary vision of me arriving on some sort of astral boxcar that just came along; hungry and unshaven, in need of a drink and a smoke (lot’s of black and white TV watching in those early years)…God then drops me (already, a somewhat old soul, I’m supposing, thus the alcohol and tobacco hobo reference) into the Petro family just as they were clearing the dishes from the proverbial dinner table a good 10 years after the metaphoric dessert was served. I also have two younger sisters who apparently, just came along as well. According to the little bit I know about quantum mathematical statistics, all three of us could have just as easily been caterpillars, Read more

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2%.

Economic activity expanded in the second quarter, partly reflecting growth in consumer spending and exports. Partly reflecting the stimulus checks that we all received during the second quarter. Did you spend, save, or pay off debts with yours? However, labor markets have softened further When the markets expected 70,000 jobs lost and we got some “good news” of only 51,000 jobs lost for July, you know the job market is softening. and financial markets remain under considerable stress Yep. Enough said. Tight credit conditions, the ongoing housing contraction, and elevated energy prices are likely to weigh on economic growth over the next few quarters The next few quarters – so we are going to be in this for a while. Over time, the substantial easing of monetary policy, combined with ongoing measures to foster market liquidity, should help to promote moderate economic growth. Eventually we’ll work our way out of this.

Inflation has been high, spurred by the earlier increases in the prices of energy and some other commodities, and some indicators of inflation expectations have been elevated. The Committee expects inflation to moderate later this year and next year, but the inflation outlook remains highly uncertain. Inflation has calmed down, especially with the recent drop in oil and other commodities. However, we don’t know what it’s going to look like going forward.

Although downside risks to growth remain, the upside risks to inflation are also of significant concern to the Committee. It’s a toss up. There are risks on both sides and we’re not really sure what is going to happen. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability. We haven’t fallen asleep, we are aware of what Read more

Consumer Reports has released a survey that shows that the national RE companies have successfully wrung every drop of meaning out of their so-called brands.

I haven’t had a chance to read the report, but there is enough on Inman today to get the gist:

Translation: Sellers don’t mind when an indie agent fails to show up with a folder full of Home Warranties, and they don’t care which logo adorns the business cards of the brand-name agents who do.

I am looking out my window at a Hostess delivery truck with a picture of a split-open chocolate cup cake next to the Hostess logo. I want one. I want to peel the frosting off, set it aside, eat the decapitated cupcake and chase it with the frosting just like I did when I was 10. I have an emotional attachment to Hostess Cupcakes that started the day my Mom brought home a box from the supermarket, and its been reinforced every time I have had two (you have to have two) ever since.

Every time I open that cupcake wrapper, I know what I am going to get: The plastic peels off of the frosting even (usually) if the package is warm and they taste *exactly* the same every time, even if they have been sitting on a shelf for six years. Mom brought home cheap, store brand chocolate cupcakes once….Once.

That’s how branding is supposed to work. The ad man Jerry Bulmore said that “Consumers build an image [of a brand] as birds build nests. From the scraps and straws they chance upon.” Bulmore’s sticks and straws are interactions, and what he left out is that the strongest nests are built when the building materials are consistent.

Branding a service is inherently difficult. Unlike cupcakes, its a lot harder to control the quality of the end product, and something as fragile as the emotional Read more

In 2003-05, we had the boom. We all know that now, and it basically is what it is. The picture links to the (in)famous TIME magazine cover story “Home Sweet Home,” where the ‘boom was on,’ and the whole of the market was talked about. There was a little bit of a caveat in that piece but not much. The message was: thank God for Housing, because without it, the Bush recession would be a reality. Lenders, Lend, Realtors Sell, and everyone take advantage and drink from the neverending fountain of wealth.

The bubbletalk had been swept under the rug, and we ALL were selling and we ALL were happy about some good news to take place of the dot com bear market that we’d experienced. We had a sacred duty to produce and keep spending, and encourage everyone to do the same thing. We were honored as post 9/11 patriots. . Everyone loves a winner, and this industry was winning. Nevermind the fact that anyone who took up space could get a great rate on their mortgage—Realtors were actually gaining in esteem.

The 100% investment loan was available to anyone with a 620 credit score. And Barry Bonds hit 73 home runs.

Everyone looked the other way and pretended the future wasn’t coming.

We’ve talked a little about baseball lately, let’s turn the WayBack Machine to 1998. Remember when Barry, Sammy and Mark were heroes? Mark and Sammy saved us all from the strike, and made baseball fun again. We got to watch everyone send 500 foot moonshots off of expansion diluted middle relief pitching, and it was good.

We’ve talked a little about baseball lately, let’s turn the WayBack Machine to 1998. Remember when Barry, Sammy and Mark were heroes? Mark and Sammy saved us all from the strike, and made baseball fun again. We got to watch everyone send 500 foot moonshots off of expansion diluted middle relief pitching, and it was good.

The thrill of that summer is still unforgettable, when BOTH Sammy and Mark broke Marris’s longstanding record and were briefly tied with 62 home runs, we were all enthralled. The very Ruthian nature of their achievement made it a joy to resume our love affair with baseball. Mark and Sammy hit 70 and 66 home runs that year. Ken Griffey Junior’s 56 was an afterthought.

Ten years ago, these achievements Read more

I just wanted to drop in a personal note on the blog if you will indulge me.

The last couple of weeks have been a busy time at the Blackwell house and there have been a lot of things going on! A while back, I introduced you to the real Team Eric, my family. Many of you got a chance to read about my two sons’ efforts to help others who have autism. While I have always been behind them and supported their efforts, that is about to go to a whole new level.

Yesterday, I signed a book deal with the major Autism / Asperger Syndrome book publisher to author a book that will serve as a simple and practical guide for Dad’s of kids “on the Spectrum”. I have published essays and whitepapers in the past, but have never authored a book. This is a challenge like none I have ever faced before, but I would not have it any other way. It is going to be fun.

Rest assured that this will not affect anything more than slightly altering the frequency of my posts…and then not for long. You can read into that that the Realtor.com stuff is coming. (grin) I care too much for this industry to do anything less. This is just a personal side-trip to support my boys and family in their efforts…and hopefully brighten the world a bit in the process. And I wanted to share in the excitement (read: terror) of the moment with you. (grin)

Have a great day!