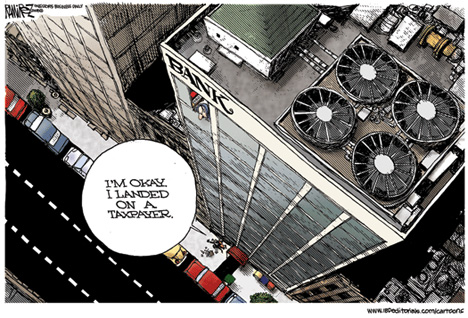

I won’t be participating in the recession. I’ve opted out.

The whole thing started when Chris Johnson slapped everyone for whining. That was an important message. Essentially, Chris has been saying, “I know it’s tough and it’s gonna be work but that’s why they call it WORK”. If you’re a loan originator facing extinction, buy Chris’ Loan Officer Survival Guide, do the homework, and start implementing. It costs about fifty bucks.

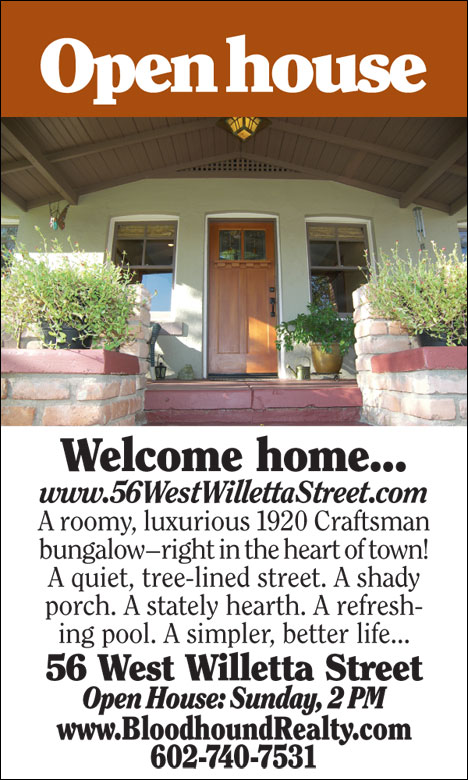

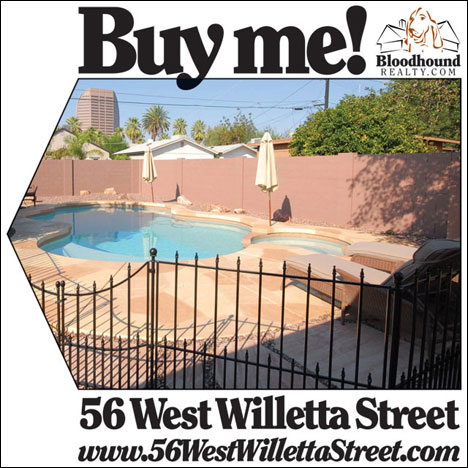

Folks who attended BloodhoundBlog Unchained Phoenix heard me talk about how to hunt for prospects using social media. I discussed how to “find a herd” through social media and “building a fence around that herd” through the system outlined in the Millionaire Real Estate Agent. If you’re in “my herd” you’ll recognize my e-mails, radio shows, blog posts, and postcards as the various slats of the fence I’m trying to build around you.

I recognized that transactions per agent were going to drop, about a year ago. I used to count on real estate agents for 3 loan referrals annually. Today, I budget for one per year. How then, can I close 100 loans annually with only one loan from each agent? Increase the agent count, or size of the herd. It’s really that simple if you understand fourth grade math.

My refinance business has all but dried up. When Hope For Homeowners was announced, I pounced. While the particulars of the programs are still unclear, I figured that stressed out homeowners would be happy to have SOMEBODY who tried to help them. These borrowers are a starving crowd. While I don’t have steak to serve them, a few might get by on the rice I do have to offer them. Commenters on Zillow’s Mortgages Undressed criticized me for outhustling them but I decided that serving needy homeowners was more important than being popular with a bunch of originators.

Jenna Jameson, actress and entrepreneur, defines courage as never letting anyone define you. Don’t let the criticism of the competitors you’re crushing ruin your career.

Do you have the courage to change your business? I suggested that the old saw “listers last” would be usurped by Read more