I have the heart of a trader. If you read Mortgage Rates Report, you know that I’m fascinated with the forces that make markets move up, down or not at all. One of the things I’ve noticed, since I started writing on Bloodhound Blog, is that the real estate industry is:

- very much protective of its sellers (often to the detriment of the buyers)

- unwilling to operate in a transparent marketplace.

That lopsided opacity was the real reason for the eventual implosion of the real estate market. We hid market information from the buyers while the Baby Boomers moved through the home ownership life cycle. A huge generation, yearning for “The American Dream of Homeownership”, assured strong demand for houses in the post-World War Two housing boom. Banks were all too happy to hand out money, even when forced to lend by the Government. Lew Ranieri saw a 25-year boom ahead and found a way to create a shadow banking system that could “bury bad loans”. Any agent dealing with a short sale understands the problem of buried loans because she’s heard:

“Well, we aren’t quite sure WHO owns this loan”

Kind of sounds like the forensic audit of Bernie Madoff’s books, doesn’t it? That’s what you hear when the jig is up on a Ponzi scheme: confusion, wagon-circling, and practiced deflection. It eventually catches up with the schemers. I’m firmly in the camp that no matter how many incentives we offer to stave off the inevitable forced sales, or to provide a middle-class tax cut, or to bribe the next generation of buyers, the simple fact remains that we have more houses than we need in this country…and the people just ain’t buying like they used to.

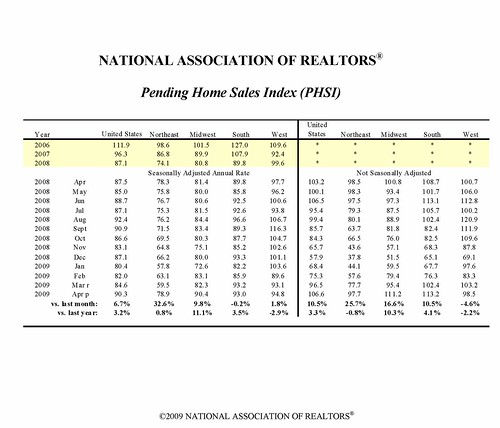

It’s partly the National Association of REALTORs fault. They’ve hoarded supply data and intentionally suppressed demand data since inception. Suppressing the demand data resulted in a valuation system that relied on false positives (comparable sales) as a standard that contributed to the Ponzi-like atmosphere in the real estate market. Think about it. When we ask agents about rising demand, they point to dwindling supply as a measure of it. Read more

Hey, you’ve been a great audience. Now I’ll turn the stage over to not a good friend of mine who definitely has not been doing any steroids or performance enhancing drugs. His jokes sucked before he looked like this too.

Hey, you’ve been a great audience. Now I’ll turn the stage over to not a good friend of mine who definitely has not been doing any steroids or performance enhancing drugs. His jokes sucked before he looked like this too.