My apologies for my recent absence. I came down with a cold — a warning from god about going to Seattle in the Winter — then got bit in the ass by a long-standing Real Life Dilemma. I missed all of the vendorslut “news,” so I don’t even know how deeply inspired were the attendees by being yelled at by Gary Vaynerchuk. (“C’mon! People! It’s not customer service unless you emote from the throat!”)

Am I being hypercritical? I don’t think so. We’re all of us victims of bullshit now and then. The trick is to scrape it off your shoes before you track it all over everything.

Meanwhile, Brian Brady shot this to me by email:

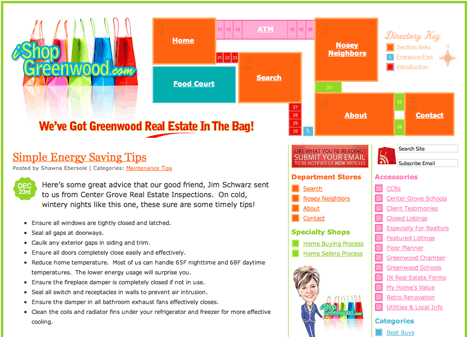

Shawna Ebersole asked us to critique iShopGreenwood.com and give her some ideas for promoting her weblog.

Well. At the risk of seeming hypercritical, I will say that the site seems to me — a male specimen — to be girly and cluttered. The overarching them is High Concept — which means you have to figure it out. No, that’s not a collection of girly-colored boxes, it’s a mall, a big-city indoor shopping mall.

Even so, I don’t care. I don’t care for the colors and I didn’t like having to figure out what was going on, but I don’t think that hurts anything. I also don’t think it helps anything. There are a zillion much-less-clever real estate weblogs, and they probably do just about as well as this one.

But here’s something I really, really liked: The site is very rich in content. My take is that Shawna Ebersole predates real estate weblogging by quite a while, and she seems to have retained every bit of the content she had developed before she took the plunge with a blogsite from Jim Cronin’s RealEstateTomato.com.

Isn’t that a bad thing? I don’t think so. I’ve written before — and should write more extensively — about the idea of satisfaction — feeling full. When people are sampling any of your marketing, they need to be able to consume enough to “feel full.” No one acts before they’re ready to, and you have to hang Read more